At the time of writing this part of the post, I have not checked the rates available. Anything I write up until the rates is beforehand. It is always interesting to see whether what I think has happened based on the news and emails has actually happened or not.

The main reason I started these monthly posts was because I found what I read in the news about rates was not always accurate.

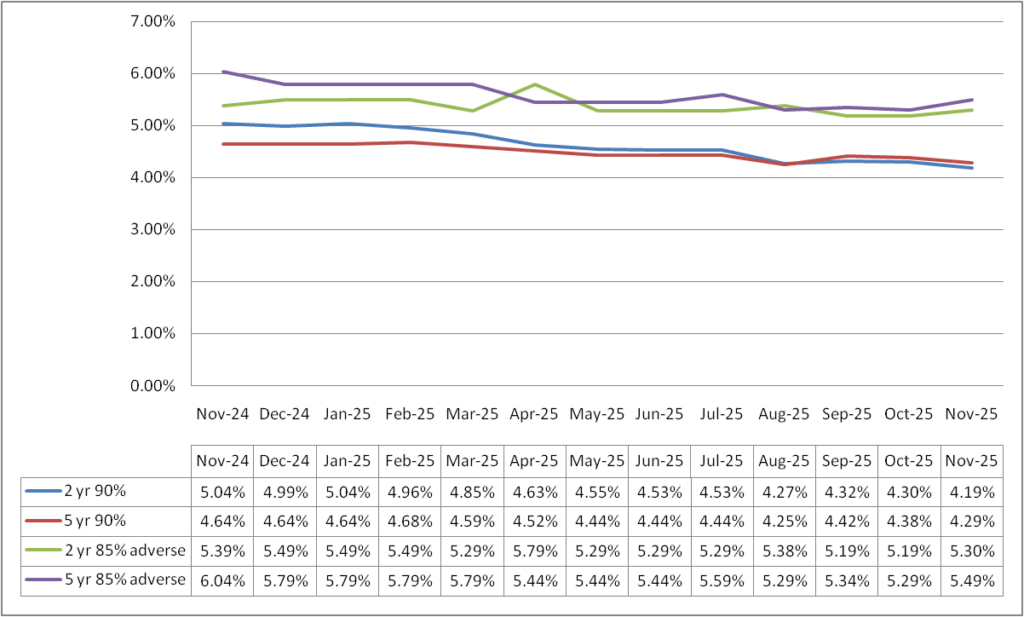

With what I have seen in the news and my inbox, I am very much expecting rates to have come down. The expectation is that the base rate will come down at the next update and so I think lenders have lowered their rates already in preparation for that.

Mortgage rates have been fairly steady since August/September so it will be interesting to see if rates have actually come down or if the emails I have received are mortgage lenders knocking 0.01% off here and there. .

What mortgage rates we are looking at?

As ever, we always look at the same 4 scenarios for some consistency. The 4 scenarios are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

*Adverse in these examples is someone with 5 defaults from 2 years ago. Enough to mean we cant go to the high street.

What mortgage rates are available now?

I was expecting to have seen the standard rates to have increased going off what I have seen in emails and and read in the news. But with the exception of August, they are as low as they have been in the last 12 months – although probably in the last 3 years!

Its not too dissimilar with the adverse rates. 2 year is the same, 5 year is lower – that is less surprising as I have seen a bit of a mixed bag in emails from the specialist lenders.

Summary

If we look at the 90% products, rates have come down by around 0.1% in the last month. Im not sure what to think about that, I honestly thought it would be more going off the emails I have seen.

When we look at the adverse rates they have crept up a little. However this is easily explained. You can see from the table that the green and purple lines jump periodically. This is not because lenders are increasing their rates, its because the lenders who are typically leading the way with rates pull their products – this is normally due to them being busier than they would like. It allows them to keep on top of service levels. I imagine at the next update these will have dropped again.

This months budget

I have heard so much about this budget, most of it is conflicting. I am not really sure what impact this will have on mortgages so will keep this section to a minimum. The next update we should have a better idea of how the market reacted to the budget and also a better idea of what impact it will have on the base rate review next month.

Summary

I think its been very much more of the same this month. Rates have been edging down – the adverse rates would likely have been lower if I had done this research last week.

Lets hope everything remains calm and steady at the next update!