Mortgage options for first-time buyers and those with bad credit can be limited but when it comes to Mortgages for first-time buyers with bad credit, speaking with a specialist broker such as Mortgage Success can pay dividends for a bad credit first-time buyer.

Guide to Mortgages for First-time Buyers with Bad Credit

In this post we will discuss the following areas to give you a more in-depth look at what is involved in applying for a first-time buyer mortgage, when you have some adverse credit.

- The best advice if you think you have bad credit!

- Can I get a First Time Buyer mortgage with bad credit?

- How to get a mortgage with bad credit?

- What are my Mortgage options as a First Time Buyer, with Bad Credit?

- What rates can I expect?

The best advice to anyone thinking of applying for a mortgage!

The best advice we can give to anyone thinking of applying for a mortgage, whether you know you have some adverse credit, a lot of bad credit or you are not sure is…..

Get Your Credit History Files Before Anything Else!

Before you call your bank, speak to a broker or go online and do a mortgage comparison check, always, always, always check out your credit reports before applying for a mortgage.

Once you make the application (and if you have bad credit) you have put it on record and any unsuccessful application can seriously damage your chances, so again, always check your credit reports before applying for a mortgage.

The three main credit reference agencies are TransUnion (formerly Callcredit), Equifax and Experian.

Once you have your credit report(s) check that all the information on your credit records is correct and if you have some adverse credit markers such as Late Payments, Missed Payments, Arrears Balances, Delinquencies, CCJ’s, IVA’s or Debt Management Plans still showing on your report, give Mortgage Success a call.

Can I get a First Time Buyer mortgage with bad credit?

Whilst getting a mortgage as a first-time buyer can be difficult enough, with higher deposit demands from most lenders, the situation does become more complicated when you throw adverse / bad credit into the mix.

If you followed our first piece of advice and have your credit report(s) then you can simply give Mortgage Success a call and we can discuss your options.

Alternatively, please read on.

The answer to the question of getting Mortgages for first-time buyers with bad credit lies in the type of bad credit, how long ago this was, and crucially, what level of deposit you have.

The Bigger the Deposit, the Better Your Chances

In short, the higher the loan to valuation of a mortgage, the greater the risk to the lender.

As you can expect, if a mortgage applicant can get a better rate of interest with a larger deposit, the same rings true for those with bad credit. But in the case of first-time buyer applications, the bigger the deposit you have, the more options will be open to you, if you have bad credit, but a large deposit.

How to get a mortgage with bad credit?

Even if you have only had one or two late payments from your bank loan, bank credit card, or a couple of bounced direct debits in the last 6-12 months, high street lenders have access to a lot more of your banking history (if you bank with them) and if there is any adverse, more often than not, your high street bank is likely to be a source of disappointment.

This is why we always recommend that you get your credit report/s, so that you can see for yourself what challenges you face.

At Mortgage Success we have placed mortgages for people with some seriously adverse credit and fairly current bad credit such as CCJ, IVA and recently discharged bankruptcy.

So, if your bad credit amounts to just a few late payments, we can safely say, that, all other things being equal, there will be mortgage options for you, from a selection of specialist bad credit lenders.

As a first-time buyer, you don’t have the luxury of having a good mortgage repayment history and as such greater scrutiny is placed on the rest of the information available to the lender, so if there is any bad credit, we know which lenders would be suitable to your individual circumstances.

From the negative implications of Pay Day Loans and getting a mortgage to late payments and more serious CCJ issues, we have placed mortgages for some seriously poor credit so dont hinder the process by blindly applying for mortgages without speaking to a bad credit mortgage broker first.

What are my Mortgage options as a First Time Buyer, with Bad Credit?

The easiest bad credit mortgage for a First Time Buyer to place would be one were there are joint applicants with good income, good levels of affordability, with a sizeable deposit and negligible adverse credit, perhaps a missed payment or two.

However, the options that are available to you increase with perceived lower levels of risk to the lender.

Whilst you cannot change your income and affordability easily, and If you cannot increase the deposit also, you may want to consider using a mortgage guarantor.

Using a guarantor such as your parents does come with financial risk to the guarantor, so it is not something to enter into lightly.

However, if the risks are explained, understood and a guarantor is happy to help you onto the property ladder then it is worth noting that mortgage lenders will tend to be a lot more comfortable lending to applicants with bad credit, if they can offer a guarantor to support the application.

Your guarantor will need to have a good credit score and enough capital (or equity in their own home) to cover your mortgage payments, should you fall behind on yours.

What rates can I expect?

It should be pointed out that the following example interest rates are only a guide and do not constitute a guaranteed rate for any applicant as any mortgage rate is subject to your circumstances at the time of the application and the available rates on offer and what terms and criteria those interest rates are applicable to.

As always, for the latest up to date and more personalised rates, give us a call.

Example One – £150,000 purchase price / Up to 3 Defaults / 3.09% with a 5% deposit.

Mortgage Success could obtain rates from 3.09% with a 5% deposit for a mortgage applicant who had up to 3 Defaults, so long as they were satisfied over 12 months ago,

The rate goes down to 2.99% with a 10% deposit if they were satisfied over 12 months ago or up to 4.95% if the defaults are not satisfied.

The rate goes down further to 2.39% with a 15% deposit or 3.5% if the defaults are not satisfied.

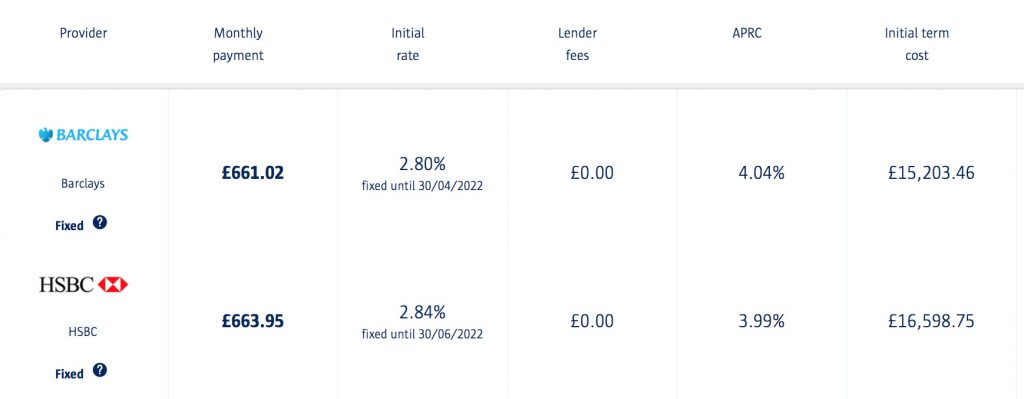

For comparison, as at today a £150,000 First Time Buyer mortgage from Barclays and HSBC at 95% LTV, and no bad credit, the rates from Barclays and HSBC are 2.8% and 2.84% respectively.

With up to 3 defaults it is very encouraging ,that a bad credit first-time buyer can get 3.09% with a 5% deposit given a squeaky clean application and credit history can get 2.8% and 2.84% on a 95% LTV from the High Street.

It goes to show that even with a smaller deposit, and moderate adverse credit, you still have options but the larger the deposit, the better the rate.

What Next?

An initial enquiry with Mortgage Success is free and with no obligation but we can quickly assess your mortgage eligibility and the likely options of getting Mortgages for first-time buyers with bad credit so simply get in touch to discuss your options.