Protection Insurance is one of those things that is better to have and not need, than need it and not have it so we thought it might be useful to look at some protection insurance claim statistics, to put insurance into some useful context.

When discussing Protection Insurance with customers we try to tow a line of not sounding like dodgy Insurance salesmen but also covering off our requirements as Mortgage Brokers.

Ultimately, we have to make you aware of the options out there and why it may be needed but once we have done that our responsibility ends and ultimately we have done our job regardless of whether or not you take out a policy.

There will be no pushy Insurance sales from us.

Here are some facts and figures that may make you think about whether or not it is needed.

Protection Insurance facts and figures

According to Aviva in the whole of 2018, their Protection arm paid out £957m to their customers.

Over 26,000 customers benefited from a payout from one or more of Life Insurance, Critical Illness or Income Protection.

98.9% of Life Insurance Claims were paid out. Those that did not pay out were mainly either due to the policy definition not being met (which I can only assume means the person had not passed away) or there had been some sort of misrepresentation either on the initial application form or on the claim form – which shows why it is important to answer the questions truthfully.

92.6% of Critical Illness claims were paid out. Most claims were made for people in the age range of 40-59. Just under 5% of claims were declined due to not meeting the policy definition with the remainder made up of misrepresentation.

87.3% of Income Protection claims were paid out. The average age of a claimant was 44 but almost a third of claims were from people under 40. The largest volume of claims was from people with Mental Health conditions (which is not covered by Life Insurance or Critical Illness). Over 7% of claims were declined because of misrepresentation and the remainder was due to not meeting the definition or criteria.

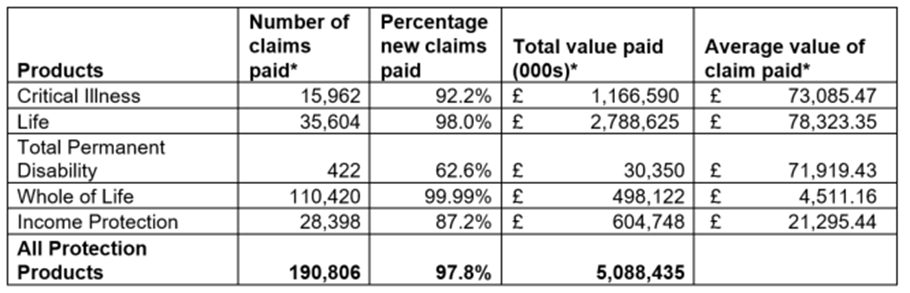

The Association of British Insurers (ABI) and Group Risk Development (GRiD) show that the insurance industry paid out a record £5 billion in protection claims in 2017 – representing an increase of more than £340 million year-on-year. Also, the total value of claims paid for critical illness passed £1 billion for the first time ever

Summary

I think the interesting thing about this information is the broad range of claimants. There are men and women from under 30 to over 70 making claims for things such as mental health through to cancer.

Many people think policies will not pay out (ie they do not trust the insurer) or they do not need it but with almost £1bn being paid in a year alone (£2.6m a day!) and no less than 87% of claims paying out, that shows there is a need out there and that Insurance companies do pay out where the application forms have been filled out correctly and the definition has been met.

How can Mortgage Success help?

As mentioned at the beginning of the post, we have to tread a fine line of making you aware of insurance products out there and if you have concerns explaining where those concerns may be unfounded but also not coming across as pushy salesmen. This is why reviewing Protection Insurance Claim statistics can help you in evaluating your needs.

Ultimately, our job is to get your mortgage, but we also have a responsibility to ensure you have thought about what would happen if you could not work or if the worst happened and you died before the mortgage was paid off.

Ultimately, our job is to get your mortgage, but we also have a responsibility to ensure you have thought about what would happen if you could not work for example.

You are under no obligations from us to take out insurance and whilst we are more than happy to obtain quotes for you, there are no requirements to take them out. If you do not want a policy, tell us.