So we have come to the end of another year! Its been a bit of a mixed year to say the least. I cant help but think of it as a rollercoaster but nowhere near as fun.

We started the year still coming to terms with mini budget! Rates going up and people were worried or concerned about mortgage rates. We had no idea where it would end.

We ended the year with rates coming down and people a little more positive about the future. But this post is more about our year and how we have done and where we are.

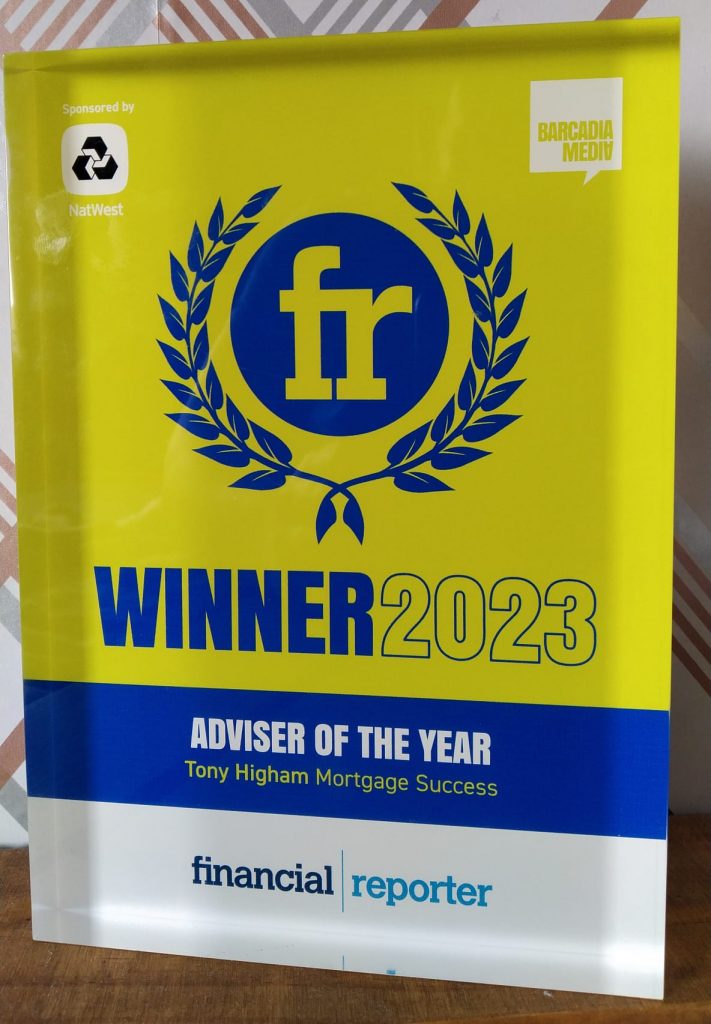

Award Winner

How can I not start with this? At the beginning of the year, I was nominated for an award by a customer. It was an award I ended up winning back in May – Adviser of the year 2023 with the Financial Reporter Awards!

For those of you who do not know, The Financial Reporter Awards are one of the 2 big awards in our industry. Its not one of those book a table and win an award kind of things.

There was a nomination process (which came as a surprise) and then a section where I had to explain what I do, why I do it and why I think I deserve an award – that does not come naturally to me and it was a struggle to blow my own trumpet.

I know its the done thing to say just being nominated was great – it is true though. I do not do what I do to win awards. But I do work as hard as I can on every case as I really do enjoy my job (there are the odd days I think otherwise though haha). But the lady who nominated me had tears at the outset of their mortgage journey as they had been through a rough year or 2. It really did mean a lot to be nominated.

However, to go on and win was extra special. Especially as I know a lot of brokers and I know they work just as hard.

Top 3 Mortgage Broker in Stockport

ThreeBestRated.co.uk has given us a spot as one of their top 3 Mortgage Brokers in Stockport. This was also a nice award to be given. It is given based on scoring from 50 different areas, this includes reviews from customers, experience, responsiveness etc. To score so highly across so many different areas makes me think we must be doing something right.

As with the above award it was great to get nominated and awarded a top 3 position. Whilst this might not be as prestigious as the Financial Reporter Awards, it is certainly nice to know we are scoring consistently high across a large number of areas.

The numbers

Every year I try to give an idea of how much we write in mortgages. Its nice to read back and see it hopefully going in the right direction…

However this year is the first time I have noticed a drop in nearly 10 years. The mini budget last year was almost like the beginning of what was to come. Combine that with the war in Ukraine, increase in interest rates, the cost of living and people generally starting to feel things getting difficult I think it was inevitable that this year was going to be difficult.

Last year we topped £10m in Mortgages, this year however it was a little under £7m. That is quite a hefty drop! Unlike many brokers who will tell you everything is good all the time, I think it is important to be honest. It helps to build trust and a quiet period may influence your decision on whether to buy or hold off.

But we have still had some really good mortgage success stories this year though. They have tended to be a little different to our normal success stories (less adverse and more other quirks to overcome).

One of my favourites was where we managed to secure someone a rate of 3.5% this year (getting anything below 4.5% this year is pretty much unheard of making 3.5% is pretty special) on a 5 year fix saving them over £4,500!

Looking forward to 2024

Despite the drop in business we will still be around in 2024. I know some brokers have gone or are struggling. Do not worry, we will be here in 2024 and beyond.

At the back end of 2022 we put together a plan. That plan was in preparation for a slow 2023 and 2024. Within the last few months as interest rates on mortgages have dropped and house prices seem to be levelling off we are actually getting more enquiries. That leads me to think 2024 we might get that Spring time bounce we missed this year.

Im not one for predictions as I am inevitably wrong. However I think it is safe to say we are prepared for the worst but optimistic that things will be better next year than they have been this year. Enquiries are on the up and rates appear to have peaked, fingers crossed!