At Mortgage Success we love first time buyers! After 11 years as a Mortgage broker I still talk about the buzz I get when I get to tell First time buyers they have a Mortgage offer. It is a genuine buzz! I remember getting my first mortgage before I was a broker and the excitement when I received the call to say I had the mortgage!

With that in mind I thought lets do a top 5 tips for first time buyers.

Get a copy of your credit report

I say this to everyone, but as a first time buyer its importance will depend on your history. If you have lived at home forever then chances are there will not be any surprises on there. But if you have been to university for example, you might have had 2-3 address in the last few years. This can mean bills were missed and have defaulted.

It is not a problem if there are issues, but it is best to know about it before we apply rather than after. If you do it soon enough you can also try to resolve any problems which can take a while to go through.

Think about your budget

Its not a problem if you want the maximum you can get. But it is important to consider what you can afford. If you have lived at home all of your life, you have probably not had the joys of paying for council tax, utility bills, TV license, food!… (spoiler… its far less fun paying for council tax than it is a night out) etc.

If you have mum and dad around, it is worth discussing what those costs are – there costs will likely be more than yours will be (bigger home, more people etc), but its a good starting point.

This in turn can help you to determine how much you think you have available to pay for the mortgage.

Do not rush

Chances are you will be spending 6 figures on something and it will be the biggest transaction of your life (so far). Get your documents together – bank statements, payslips, ID etc.

Do not get caught up in the moment when making offers on homes. If the agent is saying they have had a higher offers… it does not mean they have higher offers. Have a figure in mind before you go to view it and stick to it. But at the same time, do not dig your heels in unnecessarily… If you are offering £199,500 on a property and the vendor wants £200,000 are you prepared to walk away from the ideal home for the sake of £500?

As much as it being a decision made by the heart you do need to also use your head. Chances are your gut will tell you if it is the right or wrong decision. But just remember it is the agents job to sell the property, they work for their seller – they may be very nice to you, but ultimately their allegiances are lined up with selling the property.

What do you want from your mortgage?

Most people say the cheapest rate, but usually when we delve down that is not usually the case. Cheapest usually comes at a cost.

Will it be a variable rate and you want a fixed rate?

Maybe it will be a fixed rate for 5 years and you only want to fix for 2-3 years as you plan on moving or maybe you want to fix for 10 years?

Will it be with a lender who will take 3 weeks to review your application? Cheapest rates can mean the longest waits.

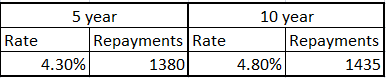

What do you want from your mortgage? What are your plans? Is this a short term purchase or is this your home for life? That is the biggest question I think as that can help you cut out a lot of products. Its not uncommon for people to be unsure. There are times where we provide customers a little simple table like the one below to help them.

These are all of the little things people do not consider but where we can help out to ensure you end up with the product that is most suitable.

Find a good mortgage broker

This one was obviously going to make the list. But it has not made the list because we are biased, it has made the list to explain why… As YOUR broker (you have to remember an estate agent works for the seller, we work for you) we are able to offer help and guidance.

- How does the process work?

- What type of survey do I need?

- How long does it take?

- Do I need a solicitor (and if so, when)?

- What does this or that mean?

All of the above are fairly common questions. Who do you ask if not your broker? Mum and dad? Friends or family? Thats fine, and they can be a great resource if they have been through the process recently. But chances are they will have only been through it once in the last 5-10 years. We have been there, done it and got the tshirt.

In addition to the above, I think where a good broker adds value though is:

- We will deal with the estate agents for you once your offer has been accepted.

- We will review your application before it goes in to improve your chances of success and to try avoid or pre-empt any problems.

- If there is a problem, you have someone experienced to fight your corner.