Have you found that you are struggling to get a Mortgage? If so, do not panic you are not alone. The aim of this post will be to look at the reasons for why you are struggling and what can be done to help you overcome it.

This article has been split up into:

- Bad credit,

- Affordability,

- Income,

- Other issues we have come across

Is Bad credit preventing you from getting a Mortgage?

If you have looked around our website, you might have noticed that most of what we do is helping people to overcome their bad credit issues and to get a mortgage.

We have been doing that for give or take the last decade, so if you have Defaults, CCJs or have been in a DMP or bankrupt that is something we are in a good place to help with.

We have tons of posts on our website discussing all of this, but maybe a good place to start is our guide on Getting a Mortgage with bad credit in 2024. This has links to many of the different types of adverse you are likely to come across.

Maybe it is Affordability that is causing you problems?

This is something we have seen more and more in the last 2 years. Because of rising interest rates and house prices, it is having an effect on how much people can get. Find out how we may be able to help below.

A little bit of the boring stuff on Affordability.

Affordability for mortgage lenders is generally based on 2 things. The first is expenditure. Some lenders will base this on your expenditure and they will go through your bank statements line by line. This is fairly uncommon with the larger lenders though. The larger lenders typically use ONS figures for applicants as it is quicker and easier to assess applications.

The other factor is in the interest rate. The FCA set up a new rule a while ago which said that lenders need to stress test mortgages based on a rate that is around 8-10%. However they also said that lenders can stress test on the rate payable if the customer is fixing the rate for 5 years or more.

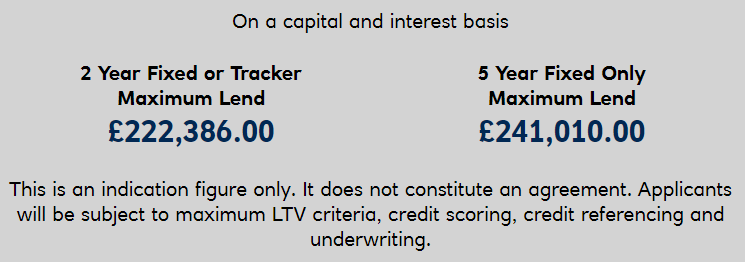

Here is an example from the Natwest website, there is over £18,000 difference between a 2 year and a 5 year fixed rate.

How can we help?

With the above in mind, there are some things we can do to help you obtain a larger mortgage.

Extending the term. If your age and retirement age allow for it, we can extend the term. This lowers the monthly repayments and in turn makes it more affordable.

Fixing for 5 or more years. As I mentioned above, some lenders have 2 different types of affordability calculations, one if you are choosing a variable rate or a 2 or 3year fixed rate and another if you are choosing a fixed rate for 5 or more years. This is probably the single biggest contributing factor to help you obtain a larger mortgage.

The right type of affordability check. If your expenditure is less than the average person, we could look at a smaller manual underwriting lender. This might allow us to get a little more and to increase your borrowing ability.

There are also other things we can do, if you have a large amount of debt in the background it may make more sense to pay some of that off and have a smaller deposit (we can check the sums for various options). We also did something for a lady a few years back where we put around £180k mortgage on repayment and £30k on interest only. This allowed her to obtain a larger amount.

However chances are in the current market if affordability is a problem, we may need to do more than one of the above.

Income problems

Problems with income could literally be anything.

- Lack of time in current job making it difficult for lenders to accept,

- Variable pay (or 0 hours contract) that may also incorporate,

- bonuses/commission/Overtime,

- Self employed for less than 2 years,

- Benefit income and/or maintenance,

- A non permanent contract. We have a good success story on that here. XXXXXXXXXXX

The world has moved on a lot in the last 20 years, it has been difficult for lenders to keep up with everyones specific circumstances. One thing I would say on this is that some lenders have criteria but for the right case they can look to bend their rules a little. This is something we can help with as we know the lenders most likely to take a view and can look at getting it pre-agreed prior to applying.

I think it is one of those where it is safe to say it is probably worth a conversation.

Other issues we have helped to overcome

This is not exhaustive, it is just what I can think off.

Foreign nationals – this has become a bigger issue since Brexit as it now affects EU applicants. On the upside however, the government have done some things to make it a little easier to get the evidence we need to show you have rights to reside.

Quirky properties – This can be very tricky. From properties with a lot of land, to non standard construction to properties with a B&B aspect or a stream in the garden! All of these things can be a problem but all of them can potentially be overcome.

Summary

It is quite difficult to summarise this page. We have over 10 years experience as a broker and nearly 20 years working in financial services. There is not much we have not come across.

It is quite nice to get something a little unusual or complicated. It gives us something to get our teeth into.

I am not sure this article quite explains what we have come across over the years. Safe to say however after 10 years we are still seeing things we have not seen before which helps to keep it interesting.

If you are struggling to get a mortgage, please do get in touch. We would be happy to discuss your circumstances and see if we can help.