When I write the Mortgage Success stories, its not uncommon that I write about us doing the research for the case. I am not sure people are aware of what goes into the research. I imagine there is a little more to it than people expect.

In an average year, we only end up with around 2 declined applications. I would like to think that is because we do a thorough job at the research stage.

Mortgage Research tends to fall in to 3 areas, I will explain those in more detail and how we go about it.

Affordability Research

We have some software which allows us to plug in the details. This will run the numbers with the lenders and pull back the results which sounds nice and easy doesnt it? In theory it is and in some cases it works exactly as it should. However it is not always correct.

A couple of examples of where it may fall out is “Location”. Some lenders ask about where the property is based (London, North West, Wales, West Midlands etc), they do this because it helps them to tailor the affordabily calculations. People in London for example probably spend more than people in Scotland. With these calculators, they do not take that into account.

Likewise, not all of the fields we have marry up with all of the lenders affordability calculators, a good example is child maintenance, we always have to double check those.

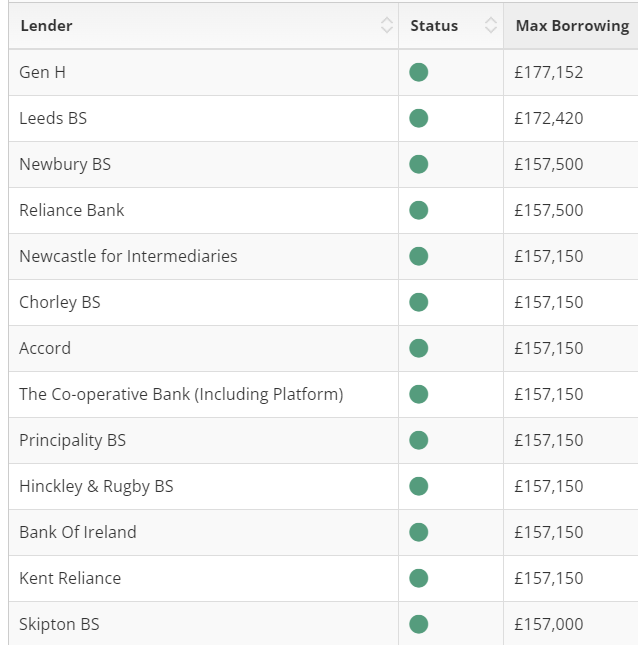

We have to take the below with a pinch of salt, but it gives a good indication. In the example below the list carries on further down, but the majority are green and passing which means we are probably pretty safe with any lender. Where the options in green are much lower, it is always worth double checking them manually just to be sure.

Criteria Research

This can be anything that falls outside of the norm. Things like Adverse, flat above a commercial property, needing to use maintenance income, the list is endless.

We ask you to complete a factfind and send over a copy of your credit report. These are the documents we use to look for any potential problems or quirks that might rule out some lenders. There are tools for this, but I find they are not the most reliable so I still do it the manual way and speak to the lenders or check their websites directly.

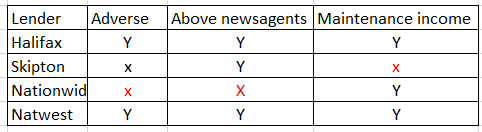

I then put together a table similar to the below. In this example the client may have a default from 3 years ago for £1,000 and be looking to purchase a flat above a newsagents using maintenance income. We would rule out Skipton and Nationwide due to their situation not being within criteria.

Please note, this is not real research. This is just an example of how we try to reduce down lenders where there are issues to overcome.

Product research

Now we have got to the point where we can rule out lenders due to criteria and affordability, we can start to look at the product.

This is where we narrow down the products, so if the client is looking for a 2 year fixed rate with a free valuation and no upfront fees, this is where we would put all of that in and our system would filter out the products not applicable. It is similar to some of the systems you may find online. However ours is updated twice a day and is generally speaking much more accurate with far more filters on and lenders who you may not necessarily come across using the online sites.

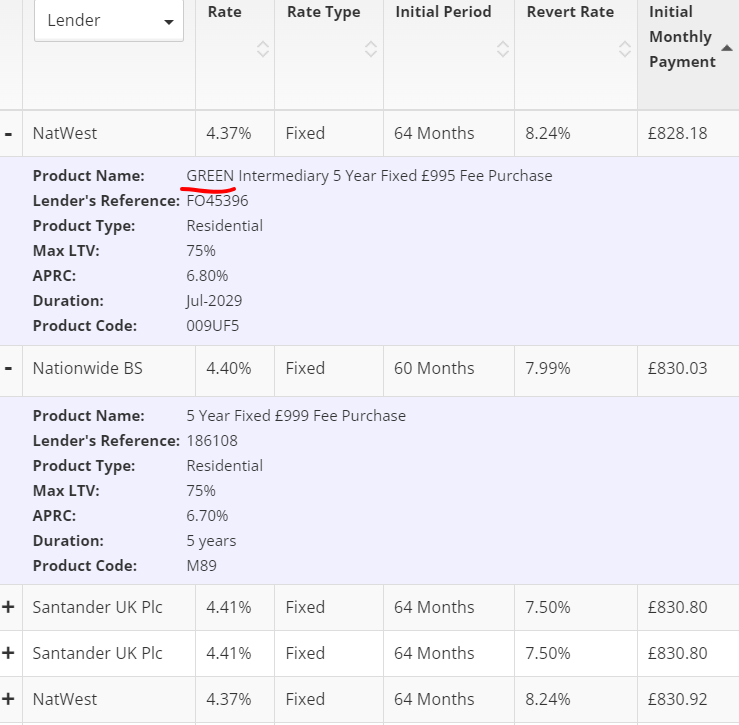

When we get the results it will look something like this. You will notice that underneath the cheapest deal which in this case is with Natwest, there is GREEN underlined. This is because you can only take out this deal if you have a certain type of proeprty. The nationwide product and santander do not have that stipulation. It is important as an individual you may miss that and think you are applying for 4.37% but unless your home fits the additional criteria you would not be accepted for that product.

Summary

So there you have it! A whistle stop tour of what goes into our research. You may think you are straight forward, but there is a good First time buyer success story here where our clients thought the same thing but we picked up a potential issue they had not even considered.

I do not want to make out our job is rocket science as for most part it isnt, but it can require a high level of attention to detail. Hopefully that shows you it is not just a case of going for the cheapest rate and you can start to see how much work goes into research.