This week’s blog post I thought would be a good idea to look at doing a regular post on what is happening with mortgage interest rates. They have been all over the place since the mini budget back in 2022. With that and the news, its not surprisingly causing some confusion.

With that in mind, I thought if we pick 4 scenarios and do the same thing each month (or there abouts), we can get an idea of what is actually happening.

What mortgage rates will we look at?

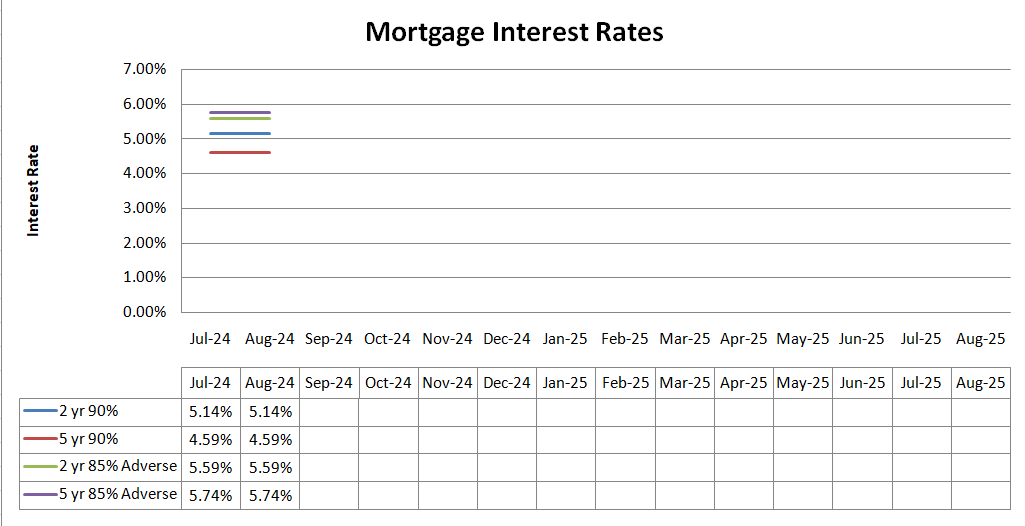

Each month I will do the research for the cheapest:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999ish fee for adverse*

- 5 year fix at 85% LTV with a £999ish fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

What mortgage rates are available now?

So with this being the first month I have done this the tables will look a little sparse.

Please ignore the rates for July, the only way I could get the marks on was to include 2 months worth of data. This will correct itself from next month. There are also a couple of anomolies I think need to be noted. There are cheaper products out there. However these products are only available to certain people. For example people who live in certain postcodes or are staying with your current mortgage lender. I have not included those products. For the adverse products, I have also ignored the lenders who credit score applications as realistically although it is within criteria, the likelihood of being accepted is very very low.

Summary

There is not too much to summarise from this months data. However one thing I have noticed over the last 12-18 months is that the 5 year fixes are cheaper than the 2 year deals. This is something I have not seen before in 12 years as a broker. It has only happened since the mini budget.

I think once those 2 reverse, thats probably when we know interest rates are back in check.

As the months roll on and we manage to fill the table up with more figures, we can start to get a better idea of what is happening in the market place.