One question we receive a lot is “What interest rates will I have to pay if I have bad credit?”

It is a very good and valid question. If the rates are too high you want to know before you build your hopes up and start to look for a new home.

It is why we always aim to give you an indication on the very first phone call if we can. When we speak to people on the phone we generally have a couple of questions.

What information do we need to find out the rate?

The questions we need answering to help you get your answers are the following:

What deposit do you have? When we ask this, we are looking to determine what percentage deposit you will have. For example if you are looking at a £200k home and you have a £20k deposit, you have a 10% deposit.

What adverse do you have? Do you have late payments? Do you have defaults or CCJs? Maybe you have been bankrupt or in a Debt Management plan. The more accurate you are at this stage, will determine how accurate our answer will be. If you have a one or 2 defaults it might be easy to answer. If you have 8 defaults, some are duplicates from debt collection companies, a few arreas a CCJ and an arrangement to pay it gets a bit more complex.

At that point you might prefer to just send us a copy of youcr credit report. You can get a copy from Equifax, Experian, Transunion or CheckMyFile – all of them usually give you a 30 day free trial.

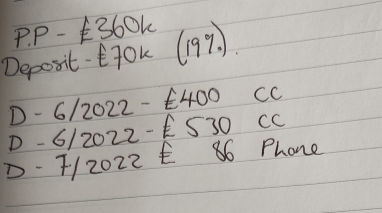

Here is an example of an enquiry we received. The customer had 3 defaults registered in June/July 2022. Two of the defaults were for Credit cards and the third was a mobile phone contract. This is enough for us to give you an indication of rates available.

What rates are available?

This is a tricky one to answer as it really depends on the level of adverse and the deposit available. It is impossible to cover off every situation, but I will go into a little more detail for some of the more common situations we come accross below. Also please understand the rates are as of today. Interest rates are generally trending downwards so you could find by the end of the year rates are lower (or even higher depending on the market).

Interest rates following Bankruptcy

If your bankruptcy has been discharged for less than 3 years you are generally looking at the specialist adverse lenders. You will usually need a 25-30% deposit and are looking at interest rates of around 6.5-9% depending on finer details.

Once your bankruptcy is discharged for 3 years or more, it is possible to get high street rates. However, if there were a lot of defaulted accounts on your credit report as part of the bankruptcy you may find we need to look at a building society where rates will be a little higher. Deposit wise you might get away with 5%, but you would have more options at 10% and 15% deposit.

This would also be the same for Debt Relief orders (DROs) and IVAs.

What interest rates can I get with Defaults

If you have maybe 1 or 2 small defaults that are historic you could be looking at high street rates. Getting high street interest rates with defaults becomes trickier the more defaults you have of the more recent they are. There is no set criteria, its one of those where its just down to taking a look at the overall profile of your credit report and application as a whole. The more positives there are = the more you can get away with.

If there is more adverse then you may be looking at small manual underwriting building societies or adverse lenders. The small building societies are looking for cases like the example above. 3 defaults, all registered in a short space of time. It is easy to see this was a blip and something must have happened at that point in time.

If those defaults had been spread out over 2-3 years, then its more likely the building societies would decline the case and we would be looking at specialist lenders. But in terms of rates we would be looking at something closer to 5-7% in the current market.

What interest rates can I get with CCJs?

CCJs are looked on in a similar way to defaults, but maybe on a slightly worse side. However the general comments above will be the same here. We are looking at how many, how old, satisfied or not, and were they registered at one particular time or over a longer period. Again though, rates you would be looking at around 5-7%.

Summary

The example above I think shows you how little we need to help determine what your options will look like. When we receive emails, the information we receive can vary sugnificanly some provide us everything we need – but that can come in a short email or in a very long email with a lot of additional information that we maybe do not necessarily need… not that the added context does not help as it can do.

Other times we can receive emails which do not really cover off the information we need. I thought this post would be useful if you prefer to email rather than call as it can ensure we get everything we need and in turn get you the information you want a little quicker. We always prefer a phone call as it gives us chance to discuss everything in more detail but we also understand you may be busy or prefer not to discuss it unless you know there is a chance.

In the current climate adverse can be placed at rates of 4% or 9%, the devil is very much in the detail which is why we just need that extra information to help get you the information you are after.

But as ever, please do get in touch and we can discuss your personal circumstances to give you an accurate answer.