This post is a follow on to my previous post here.

As rates have been up, down and all over the place for the last couple of years it is had to know what is actually happening. Last month I started what will be a monthly post on what is happening to a couple of different rates so you can see what is happening without any smoke or mirrors from various other places.

What mortgage rates we are looking at

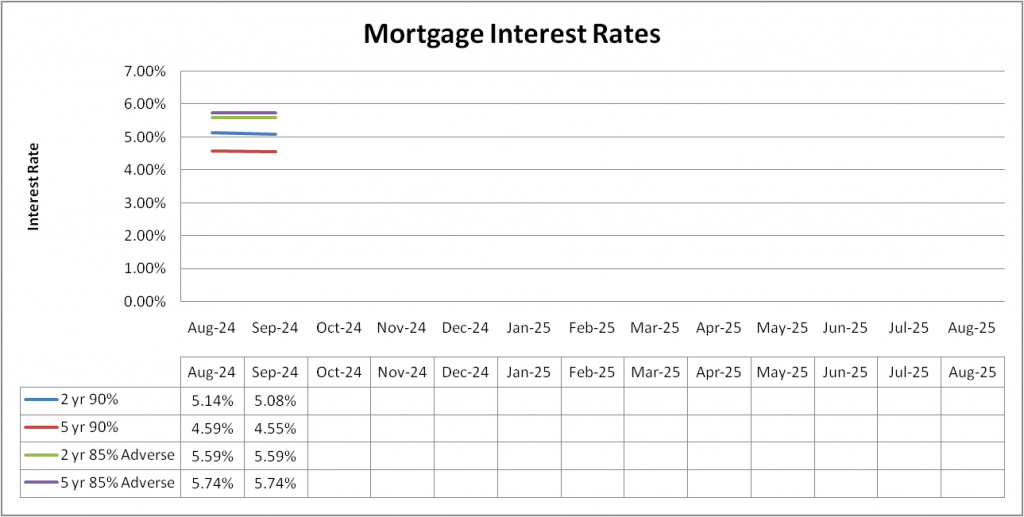

This has not changed from last month. The 4 rates we are looking at are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999ish fee for adverse*

- 5 year fix at 85% LTV with a £999ish fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

What mortgage rates are available now?

As you can see from the table below, there are some slight changes but nothing significant. The adverse rates are staying fairly steady.

That being said there was a lender earlier this month who reduces their rates by up to 1%. Admittedly they were probably too high compared to the rest of the market anyway. Despite the significant rate reductions, it has only brought them in line with other lenders. It has not pushed them to the top of the tables.

That being said, it could force some of the lenders to reduce their rates to ensure they do not start to lose business. It could be the beginning of something but with rates around 1% to 1.5% above the high street, I do not think it will be anything significant. I suspect they are probably comfortable with their pricing.

There may be a couple of anomolies which need to be noted. In some cases there may be cheaper products out there. However these products are only available to certain people. For example people who live in certain postcodes or are staying with your current mortgage lender. I have not included those products.

For the adverse products, I have also ignored the lenders who credit score applications as realistically although it is within criteria, the likelihood of being accepted is very very low.

Summary

Its interesting as this is what we have been seeing throughout the year. Rates have been edging down which individually makes little difference. As an example, a £250k mortgage over 30 years at 5.14% compared to 5.08% is around £10 per month or £240 over 2 years. Every little helps as a certain supermarket tells us, but in the grand scheme of things probably nothing significant. But multiple that up over the year and we could be talking nearly £100 a month difference!

However, in the press it hit the news when 3.99% became available and so it seemed like everything was plummeting again.

What can also make a difference though is keeping on top of the rate drops. We have a couple who we did a mortgage for back in June. Their original rate was 4.92%, we will be switching them to a new product tomorrow as they have not yet completed. The difference for them equates to around £60 per month between June and now or £3,600 over the 5 years of their product!

In short though, rates coming down marginally each month soon adds up. Or as my grandad used to say, look after the pennies and the pounds look after themselves.