You can see previous updates here.

This is the latest update to our monthly rate changes posts. But more importantly, it now also covers a full 12 months.

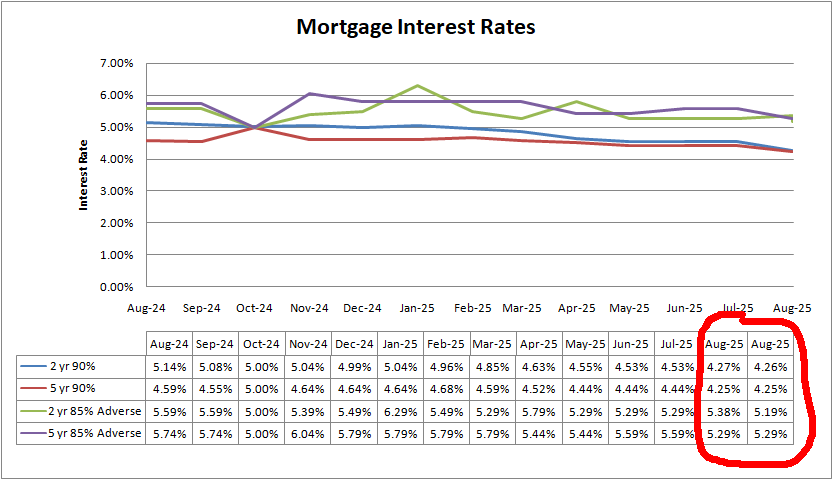

After seeing all sorts in the news about Mortgage rates being up and down, we can now see what has actually happened in the last 12 months. We have not been looking at the lowest rates on the market, we have been looking at mortgages for the average person in the real world – ie smaller deposits and/or bad credit.

What mortgage rates we are looking at?

The mortgages we have looked at are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

This has been the same for the last 12 months.

What mortgage rates are available now?

I am going to concentrate on the last 2 columns today. I think this is really important in helping people to understand what happens with mortgage rates.

The first column in August were the rates BEFORE the Bank of England base rate announcement. The second column in August is the 24th August AFTER the announcement.

When people think the bank of England base rate has come down so it will affect the mortgage rates available, you can see on this occasion (and infact most occasions) it it is just not the case.

What we tend to find is that mortgage lenders make their base rate changes in the weeks leading up to the announcement. You can see that with the exception of the 2 year fixed rate for adverse, all of the rates came down by around 0.25% between July and August (before the announcement was made). This is what we have always said happens.

The 2 year adverse was an anomaly due to the lender with the lowest rates pulling their products. But even then it only came down by 0.1% so was still an anomaly but less so.

Summary

We have always said, the banks tend to have a good idea of what will happen at the base rate announcement. Because of that, mortgage lenders tend to reprice in the 2-3 weeks before the official announcement.

We are now just over 2 weeks after the announcement and very little has changed.

If you want to secure a mortgage, you do not need to necessarily hold out for the base rate announcement. Chances are the changes have already happened by the time the announcement is made.