As we come to the end of another year, it is nice to be able to take a look at where Mortgages rate started and where they end

I always write this section before I have carried out the research. I like to think about what I have seen in emails and the news and see if that pans out in the real world rates.

My expectations is that there will have been some reductions, but nothing significant. I think this is in part down to the US Fed reducing their rates earlier in the month and the expectations that our base rate will be dropping rates later this week.

What mortgage rates we are looking at?

As ever, we always look at the same 4 scenarios for some consistency. The 4 scenarios are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

*Adverse in these examples is someone with 5 defaults from 2 years ago. Enough to mean we cant go to the high street.

What mortgage rates are available now?

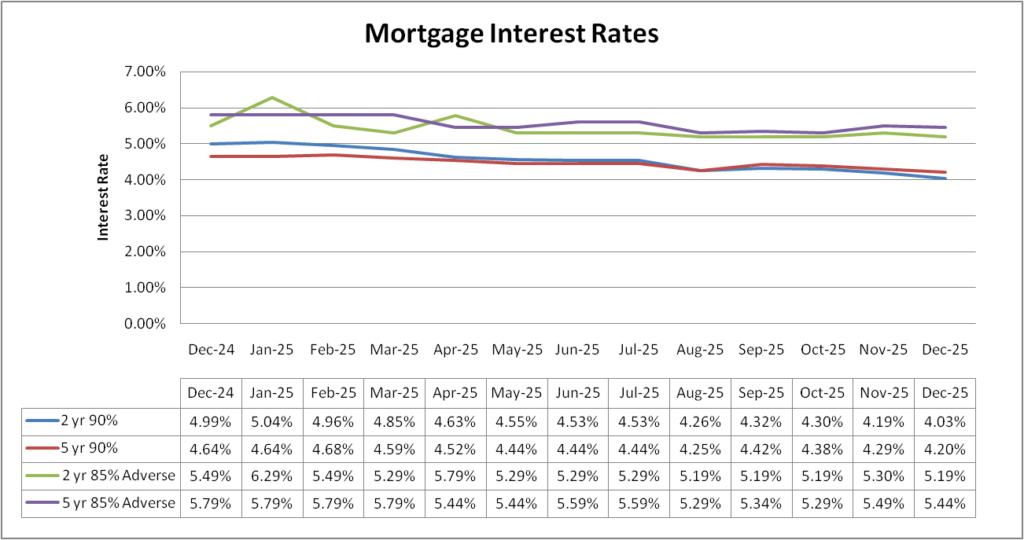

I have now done the research and the rates are below. The results are a little bit all over the place and there are a variety of reasons for that I think.

2 and 5 year fixed rate – these have come down in readiness for the expected base rate drop late this week I think. The interesting thing here however is the amount they have come down by. The 2 year fix has dropped more than I was expecting, the 5 year fix has dropped by less, but still probably a little more than I was expecting (in my mind I had maybe 0.05%).

The adverse rates, last month I said that the 2 year fix would probably drop back don to 5.19% and that I think that only went up as a lender pulled out for a month due to business volumes. That has happened and so no huge surprise there.

The year adverse fix however is still higher than 2 months ago, albeit slightly lower than last month. It will be interesting to see what happens with these next month.

Mortgage rates in 2026

It is quite possible 2 year fixed rates at 90% LTV could be 1% down on this time last year if the base rate does come down as expected later on this week. Even if they remain where they are, come January we would still be over 1% down on 12 months prior.

Every else that we monitor however is much closer to the start of the year at less than half a percent difference.

I would not like to guess on what the future holds. But there seems to be a lot of support from governments to try and get the base rates down so I can only assume that will continue, but I think like this year it will be slow and steady.

Summary

It has been a bit of an up and down year for interest rates, although they have been on a general downward trajectory. I think that will continue but likely to carry on in a slow and steady way.

I do not think it is a case of holding off doing whatever it is you plan on doing. 0.25% equates to around to around £15pm on every £100,000 over 30 years. In the grand scheme of things it is unlikely to make a huge difference to most people.

But if you are unsure, lets have a chat and see if we can help you to filter out all of your thoughts and get you on the path you want to be on. This is why we make these posts, there is so much in the news about house prices and mortgage rates even we can be unsure in what is happening in the market. It is nice to just have a table to refer back to.