When we are looking at Mortgages and discussing options, most people get caught up about the rate. But in reality for most people it is the fees that will play the biggest part in the overall cost. Although there are reasons why you may not necessarily want the cheapest deal and this will post will have a look at why you may or may not want a deal with a fee.

Overall Cost

Lets start with the big one, the cost of a fee. There are various ways to look at the cost. Examples include if you add the fee to the mortgage you start your mortgage with a higher balance. That means the first few payments will just be just paying off the fee.

Another could be in the monthly repayments, if you are saving £20 a month on a deal with the fee, that is £240 a year. If the arrangement fee is £999, that means it will take over 4 years worth of payments before you see any savings.

A 2 year deal therefore is going to be better without the fee even if the interest rate is higher. With a 5 year deal would be cheaper but there is not much in it, so it would be easy to argue either way. A 10 year deal however would make much more sense.

Monthly Repayments

When I started out as a broker we were always told to go with the cheapest deal. However I always remember when I was a relatively new broker and a customer told me she wanted the lowest repayments as she was a single applicant and her monthly expenditure was a bigger concern than the fees were.

This was quite interesting as it was the first time this had happened and as a new broker it went against our compliance. It turned out it was not the only time and with experience you start to understand some peoples priorities differ from the norm and thats not a problem.

Your circumstances

Everyone has different priorities. Circumstances may also dictate your options. A good example here might be that you are applying for a 90% mortgage that comes with an arrangement fee. The lender may not allow you to add the fee and go above 90% LTV. In that situation you have a choice of paying the arrangement fee. If you do not have that money then you may need to look at the alternative deal without the fee.

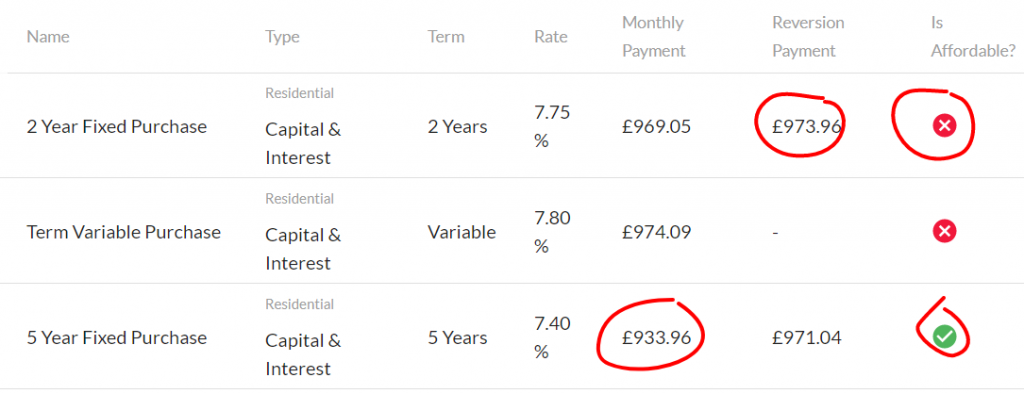

Another example could be to do with affordability. In a world where interest rates are on the rise combined with the cost of living one thing we are finding is that affordability is being squeezed. There are a number of things we can do to help with affordability issues. 2 of those examples are to go with a 5 year fixed rate and to choose the cheapest rate. This is because lenders have the ability to do the affordability checks based on the rate payable rather than a stress testing rate. By going with the deal that has the fee which is usually cheaper than the deal without the fee, we may have to go with the fee charging deal to secure the lowest

This is from a lenders website and is a good example of how affordability can work. A 2 year fixed is stress tested using the reversionary payment and that is failing affordability. The 5 year however is using the initial monthly repayment and is passing.

Summary

It is not as complicated as I think this makes out. But there are times it may not be a straightforward answer. You do not need to do anything in order to work out the best. That all forms part of the advice process. We run through your preferences in a factfind and then incorporate that into the research.