Whether mortgage brokers can get better deals than going direct is a question that crops up a few times a year. So I thought it would be a great idea for a (hopefully) unbiased post.

I am very big on the fact that we are not a price comparison service.

Yes we will always try to source you the best deal and yes we want you to pay as little as possible. But in todays world there are many reasons why you may not end up with the cheapest lender.

It can be down to personal choice (which I will expand on further down). Not fitting the lenders criteria or not fitting their affordability model. Part of our process is to discuss what you want from the Mortgage.

The role of the broker is not just to hunt out the best rate, but the best mortgage for your circumstances.

For purchases especially, many people are usually happy to pay an extra couple of pounds a month if it means their Mortgage application will be quick and painless.

Buying a home is a stressful period at the best of times, so an extra £50 a year for example may be a small price to pay for less stress.

However, we also have customers who want the lowest rate no matter what. Even if the fees mean that it is more expensive in the long run. We discuss all of this with you when completing a factfind to find out what you want from your Mortgage.

Back to the original question of whether or not a Mortgage Broker can get a better deal than going direct to the Bank or Mortgage lender….

In a word “Yes”.

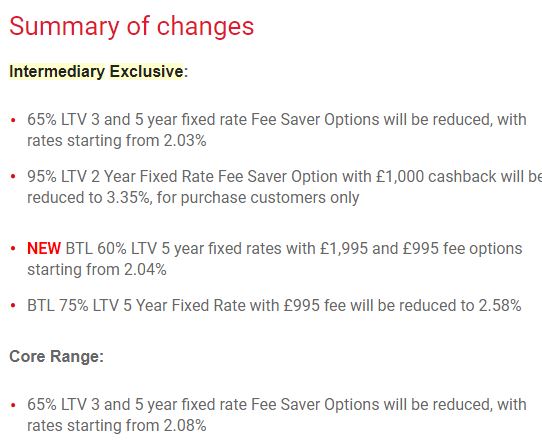

Here are some examples from emails we have received….

The last example of the 3 above, show the difference it can make, via a broker we are looking at a rate from 2.03% where as if you went direct to the bank, you would be looking at rates from 2.08% – to put that in to context on a Mortgage of £100,000 over 25 years we are talking about £2.50 a month. Not a massive difference by any stretch and this is primarily the reason why I say we are not a price comparison service. Saving 0.01% on a Mortgage is not going to make a massive difference one way or the other.

It is also worth noting that the above examples do not necessarily mean they are the cheapest or best deal for you or anyone else. They do however show that we can access deals that are not available by going directly to the Mortgage lender, which may mean you end up saving money by using a Mortgage broker AND have someone doing the leg work for you.

It is the leg work and experience where I think we (Mortgage Brokers in general) make the biggest difference rather than a marginally better rates that may be available.

To give an unbiased view point in this post, Mortgage Brokers do not have access to every deal with every lender. There are some lenders who do not deal with Mortgage Brokers directly or they may only work with a small number of Brokers. If you are confident in checking criteria, affordability and are comfortable dealing with Mortgage lenders, underwriters and estate agents yourself, there is no harm in checking what is available if you were to go directly to the mortgage lenders yourself. But by using a broker we also do the donkey work for you.