In short the answer is yes, it is entirely possible to get a mortgage if you have Defaults. However I think a more accurate answer would be to say it really does depend on your circumstances.

The idea of this blog will be to look at some facts and figures surrounding defaults (so you know you are not alone). We will look at how we can help and then some success stories from previous clients.

Defaults facts and figures.

Pepper Money carried out research on Adverse which included some statistics on Defaults.

I think the biggest surprise was that they found 7% of the population had received at least 1 Default in the last 3 years. This was up from 5% the year before.

7% of the population is getting on for 5 million people.

I dont think that is surprising considering we have gone through a cost of living crisis in recent years. Due to increase in people in financial distress that would also add to relationship breakdowns and illness which in turn will have a knock on effect with Defaults and other types of adverse increasing also. With that in mind, I expect that number will increase in the next update.

I think with the above information it is important to see that you really are now alone if you have picked up Defaults in recent years.

What do Mortgage lenders look for?

This has not changed much in recent years. When mortgage lenders are looking at applicants with Defaults, they typically look at a few specific things:

- When are the defaults from? – The older they are, the better. Likewise if there are a few defaults are they all dated from the same period or spread out? The answer to this will likely affect the options.

- How many defaults are there? – The more defaults there are will also affect the options available.

- Are they satisfied? – This is one of those questions that takes a lot of consideration. If they are satisfied it looks better. But will it improve your chances of acceptable?… Lets look at it in more detail.

I mentioned above that trying to get a mortgage with defaults will depend on the details.

If you have 10 defaults, you are unlikely to get a high street mortgage. This is because those lenders credit score and even if it fits criteria, the defaults are going to have a huge impact that means its going to be difficult to overcome.

In that situation, is it worth satisfying the defaults or would it be better to put that money towards a bigger deposit?

This is one of those things where I think it is worth a conversation. Our job is not to judge you but to offer you the best advice on being accepted. We will take the details down and try to plan how best to proceed to get you the mortgage you are after.

Default Mortgage success stories

You may have read our success stories page here. You can see some examples of customers with defaults we have been able to help in the past.

Defaults & Pay day loans success story

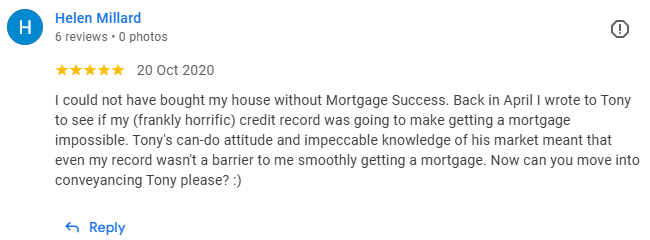

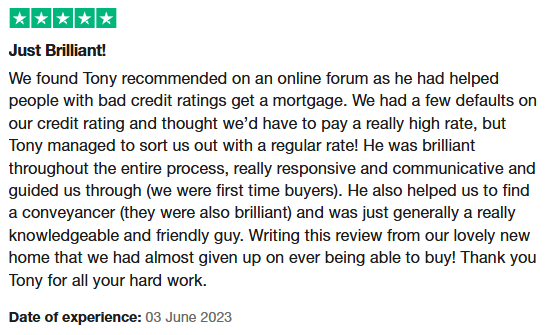

Here are some reviews from clients with defaults & adverse, so you can be confident you are in good hands if you decide to get in touch with us.

Summary

Getting a mortgage in 2025 with defaults, has not really changed much in recent years. What we were doing 5 years ago is still just as applicable today as it was then. The major difference really is that rates have gone up in recent years.

There are still people who pick up defaults for a variety of reasons from youth, to illness, to divorce and so on. We still come across people with a one of default or 10+.

I suppose in essence, we are experienced in this part of the market. We have the history in this field and you will have someone experienced on your side should you choose to proceed with us.