As Mortgage Brokers part of our job is to understand lenders criteria. We work with around 80 Mortgage lenders so it is impossible to remember everything. However there are things it is important to know so that when you we are discussing your circumstances we have a good idea of whether it is possible or not.

I have struggled to explain how this works so I thought I would give a couple of examples and a pretty picture (what more could you ask for?).

Here are the 2 examples:

Bad Credit: There is a good possibility you found our site by looking for help with Bad Credit mortgages. The vast majority of what we do is adverse so it is important we know the criteria for lenders inside out.

If you were to call up and say you had 3 Defaults from 4 years ago, I would be narrowing down our list of lenders, if you then said none of them were satisfied, I would knock a few more off the list and at that point if those are the only problems, I could give you a good indication of likely rates there and then. That is what we do for most people who call us up about adverse.

Employment: This is something that I know about, but not as well as I know adverse. However, I know that most of the adverse lenders need 12 months employment, but some can be as low as 6 months.

Taking adverse out of the equation, the best case scenario is that some lenders just need a letter of employment with a start date within the next 30 days and the worst case is 12 months with your current employer.

I could not tell you all 80 lenders stance on employment, but if you have been in your current job for 6 months, chances are you are going to have the vast majority of those 80 lenders open to you. If you start next month, then you are probably only going to have 2-3. That is something I generally do know.

Researching the sticky out bits

As Mortgage brokers, we spend a lot of our time, doing research for people. This part of the job is like the foundations of your new home, if you do this part right then your application is going to hold up and you are 90% there (the rest is down to the underwriters discretion and whether the property values up ok).

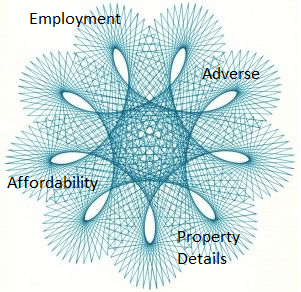

If you look at the Spirograph image below, the darker blue part in the middle is where all the lenders overlap – for example, if you have been in your job for 12 months, that will fit criteria with ever lender.

An example of how we work

You might find if you are a single person been in a job for 2 years on £30,000 a year wanting to get a Mortgage for £90,000. With no complications you fall into the dark blue section and you have your pick of the lenders.

Now imagine you also have 5 Defaults from 2 years ago, all of a sudden, you no longer have every lender available to you and so we only have the lenders on that arm to look at.

Then if you alter your employment history 2 months in the job and we only have the lenders on that arm available.

Our job as Mortgage Brokers is to then try to find a lender who will lend on every part where you stick out. The time frame for that can vary from an hour or 2, right through to a week or more and will depend on your sticky out bits.

The way I tend to work for the more complex cases is to draw a table similar to this:

| 3 Default | 2 Months in Job | |

| Lender A | Yes | No |

| Lender B | No | No |

| Lender C | Yes | Yes |

We have a list of the lenders I think may lend to you and we have a list of the issues. I then call up each lender and run the situation by them. We put a tick in the bits they will accept and a cross in the bits they wont. Hopefully by the time we get to the end of the list, we have at least one with a row of ticks.

Once we have our list of lenders, then we can start to narrow it down to the products and then we can make our recommendation.

Summary

It is not uncommon to find you do not fit with a bank, many lenders have the same criteria in the main but we also have access to companies who are a lot more flexible or can bend their rules a little for the right application.

The more complicated your circumstances the longer the research can take

We often speak to people who have already been turned down by a bank for their mortgage or people who know they are going to struggle so come to us upfront. The more complex your circumstances the longer it can take to do the research. It is never a bad idea to speak to us upfront (before you make an offer on a property), this gives us time to do the research beforehand and allows us to be a little more relaxed.