A County court Judgement (or CCJ for short) is similar to a Default. The difference is whether it is down to not making payments in line with a credit/finance agreement or not making payments in line with a contractual agreement.

How are CCJs treated?

Many lenders will treat CCJs similar to Defaults. This usually means they put a cap on the maximum value and/or number of CCJs.

Some mortgage lenders however will treat CCJs worse than Defaults. This can be in terms of credit scoring and also in terms of what they will accept. This is because a CCJ would have had to go through a court process where as a Default can be applied without having to go to court. If a person or company has gone to court, its generally accepted that it would be more serious.

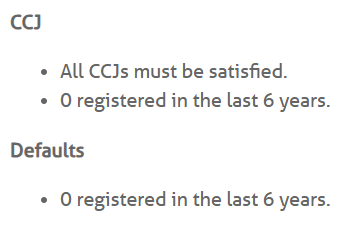

Below is an example of a lender and their criteria for CCJs and Defaults.

What CCJs can be accepted?

Although the example above says none in the last 6 years, the amount that can be accepted varies from lender to lender. I thought if we put a table with a few different options, you could get an idea of what can be accepted.

| Lender | Value | Number | Max LTV | Notes |

| A | No limit | No limit | 85% | |

| B | £1,000 combined | 3 | 70% | Satisfied for 3 months |

| B | £500 combined | 3 | 95% | Satisfied for 3 years |

| C | £500 | 1 | 95% | Satisfied |

| C | £2,000 combined | 2 | 95% | Registered over 3 years & Satisfied |

It is important to note that the above is far from conclusive, we have access to over 80 lenders. It would take far too long to put them all in a table. They are all subject to change so it was more just to give a very quick overview.

However, you might have noticed that lenders B and C have 2 rows each. This is because they in essence have 2 lots of criteria. You can have more CCJs and/or higher values if they are over 3 years old.

Our experience

We generally see less CCJs than we do Defaults or even bankruptcies. Most of those only have one or 2 CCJs. In the table above you can see lenders usually cap them at 1-3. I think this is enough for most people. But on the off chance you do have more CCJs you can see we do have access to lenders who will look at more.

I have gone through our success stories for CCJs and can only find one we have written about. This also includes a Bankruptcy. Hopefully that shows that despite the lack of examples we are more than qualified to help you obtain a mortgage with a CCJ – CCJ Success story.

Having been doing bad credit mortgages for over 10 years now, we have done probably more than our fair share of mortgages with CCJs.

Summary

We have access to over 80 Mortgage lenders. They range from high street lenders to manual underwriting building societies and then also the specialist adverse credit lenders. This means we can look at everything from High street through to very specialist lenders.

We are specialists in adverse credit and have over 10 years experience helping people in similar situations to you – quite possibly people who have been in worse situations. Unlike a lot of brokers who are generalists we know this market better than most. We will start with the better lenders and work our way down to try and find the best rate possible. We take pride in what we do and it is so frustrating to meet people who have been told they cant get a mortgage from other brokers or to see that other brokers have gone straight to adverse lenders when there were better options available.

Please get in touch if you would like to discuss your options.