All lenders now use an mortgage affordability calculator. These affordability calculators do vary from lender to lender and the amounts they will lend can be very different.

Here we look at some of those difference to shed some light on what to expect when reviewing your mortgage affordability.

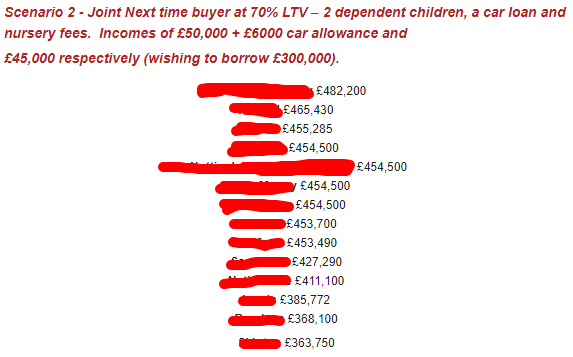

The image below is an example we receive from a company we work with, that highlights the difference in lending amounts for a particular scenario. We have removed the lenders names so that we can not be accused of bias towards one lender over another.

The interesting thing with this is that the above example is one of 2 we receive each month, it is not uncommon for some of the top 5 in example one, to be some of the bottom 5 in example 2.

It is also interesting to see that in the example above, the difference in lending amounts is nearly £120,000 from the lowest to the highest – or 25%!

The largest difference we have seen is £12,000 (that is right, it is not missing an extra 0) with 2 lenders through to around £250,000 with the majority of lenders and £280,000 with another lender.

Most lenders will work to an initial “Income Multiple” which we tend to say is around 4.5x income.

Using the example above, that fits in with our initial thinking as their combined income is £101,000 with 4.5x that figure being £454,000. If you have a large amount of debt/commitments, you may find that comes down and reduces your mortgage affordability considerably.

However, this is something we can discuss with you in an initial phone call to see if we need to be lowering that 4.5x income multiple or not, as there is no standard amount of debt which is allowed before it becomes a factor.

How do the mortgage affordability calculators work?

They all ask a number of questions about income, commitments (ie loans and credit cards) and term, some will ask about the property and your expenditure where as others will use ONS figures for expenditure.

Some lenders will automatically lend £0 if your monthly debt repayments are over 25% of your monthly income where as others will automatically lend nothing if your overall debt is 40% of your annual income.

This can be important if your had a large amount of debt and are looking to consolidate it in to the mortgage. Where as other lenders have no such rules and they may come back being happy to lend tens or hundreds of thousands of pounds.

They also take into account the term, so for example they may be prepared to lend more if you are happy (and able) to pay the mortgage off over 25 years, rather than 15 years.

As every affordability calculator is different, there are no set rules and one thing we always say is that if you are struggling to get the amount you need for the sake of £10,000, that can be relatively easy to overcome. You can see that most lenders on the above example would be happy to lend around the £454,000 mark but it is possible to lend nearly £30,000 more than that.

There are also smaller lenders who do not have affordability calculators as such, but we can sit down with them and discuss your circumstances on an individual basis and they can go up to 5 or 6 times your income. If we have to go down that route, it may mean the rates start to increase as these are lenders who will typically charge more because of the higher risks they are taking. But anything up to around 4.8x income can usually be placed at normal/relatively normal rates.

If you are struggling to obtain the amount you want or need or would like to get a more individual idea on how much you can lend rather than using generalised income multiples, why not get in touch? We are always happy to have a 5-10 minute chat to discuss your circumstances in more detail.