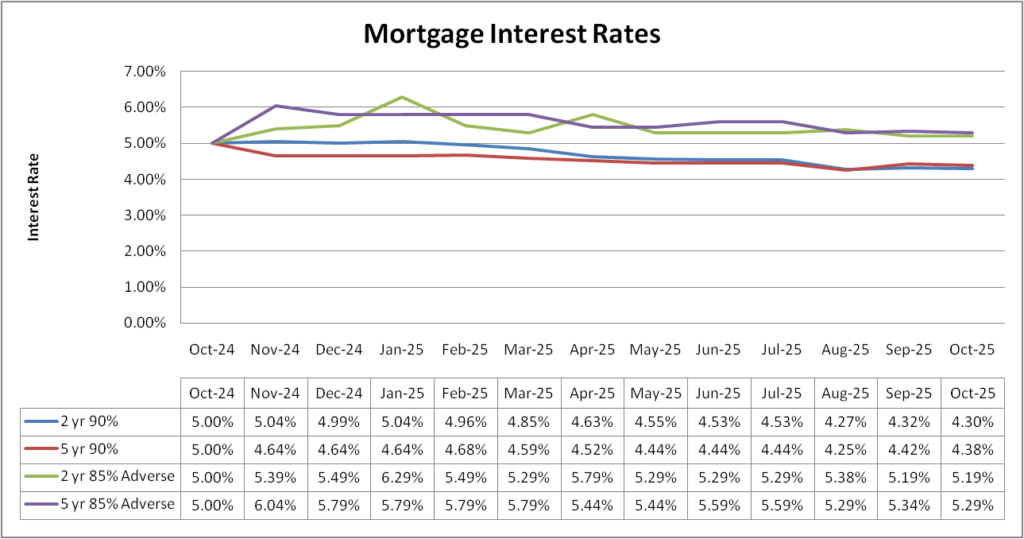

Another month, another check in to see where interest rates are. You can see our previous updates here.

The last few months have seen a bit of action. This was driven by various things – Donald Trumps tariffs (and then rolling them back, the base rate dropping and the expectation that the base will drop again in September or October.

So where are are up to?

The expectation of a further rate reduction in the back end of this year has now subsided. It is looking very unlikely that will happen. That has had a knock on effect with swap rates and in turn mortgage rates.

Going off the emails I have seen, I am not sure. I think mainstream rates may have gone up a little. The adverse mortgages I am not sure. I recall seeing some rates coming down and others going up so that will be interesting to see…

What mortgage rates we are looking at?

As ever, we always look at the same 4 scenarios for some consistency. The 4 scenarios are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

*Adverse in these examples is someone with 5 defaults from 2 years ago. Enough to mean we cant go to the high street.

What mortgage rates are available now?

We missed October 2024 and July 2025 update. This is a bit of a surprise.

I was expecting to have seen the standard rates to have increased going off what I have seen in emails and and read in the news. But with the exception of August, they are as low as they have been in the last 12 months – although probably in the last 3 years!

Its not too dissimilar with the adverse rates. 2 year is the same, 5 year is lower – that is less surprising as I have seen a bit of a mixed bag in emails from the specialist lenders.

Summary

I suppose this is good news isnt it! Rates are still competitive and are in a good place. The emails we are receiving about rate changes are presumably where they are just tinkering with the rates – ie 0.01% up or down. Which in the grand scheme of things make very little difference. maybe £5 a month difference on the average mortgage.

Next months budget

We have a budget next month, its not expected to be a great one so it will be interesting to see what effect that has on rates. In general, I am not expecting too much fluctuation in rates, but the budget might cause some surprises in which case who knows.

Fingers crossed nothing too exciting happens, after the 2023 budget, I am liking the stability/boring.