The last month or 2 has been a bit of a busy one for Interest rates. This was primarily down to the base rate dropping in mid August. You can see our post on rates in August here.

Also I recently made a post about the last 12 months worth of interest rates which you can read about here.

But lets get caught up on where we are at now and what has been happening in the last month.

Before I have done any research, I suspect there has probably a been a slight uptick in the rates from where they were at the end of August. Throughout the month we tend to receive emails from lenders telling us about rate changes. Some of them give us an indication of whether the rates are going up or down but not all. Taking a brief look over the emails, I seem to recall seeing more about rate rises than reductions.

What mortgage rates we are looking at?

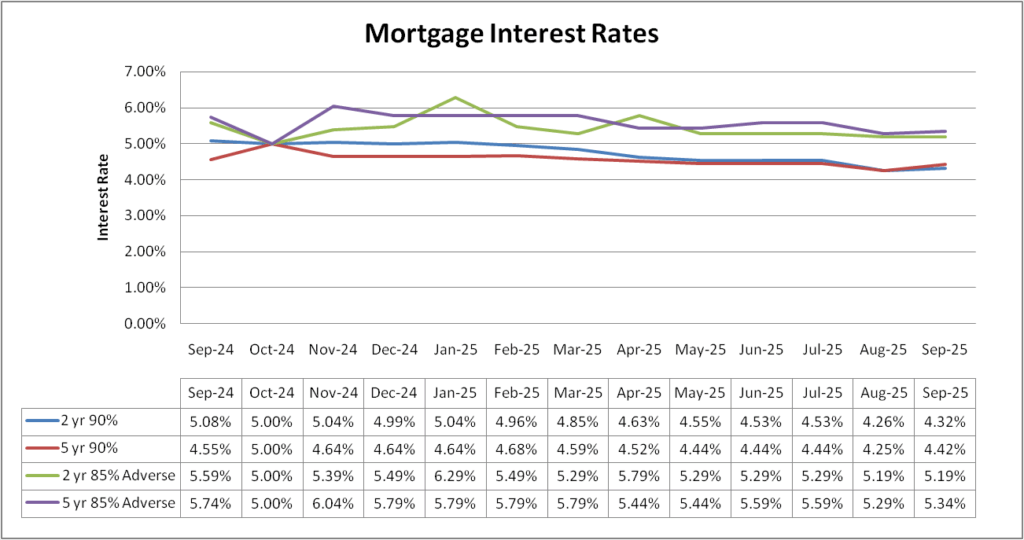

As ever, we always look at the same 4 scenarios for some consistency. The 4 scenarios are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

*Adverse in these examples is someone with 5 defaults from 2 years ago. Enough to mean we cant go to the high street.

What mortgage rates are available now?

We missed October 2024 and July 2025 update. Looking at the graph below, we can see that rates have gone up with 3 of the 4 scenarios. The 4th remaining the same as it was previously.

Although the rates have generally gone up, on average it is less than 0.1% (closer to 0.07%) which in the grand scheme of things I think means interest rates are still fairly steady with some minor fluctuations. To put that into numbers, it equates to around £8pm on a £200,000 mortgage over 25 years.

Also one thing I have just spotted, in my years as a mortgage broker (12-13) its only been since the mini budget where 2 year fixed have been more expensive than 5 year fixes. This is the first month where 2 year rates are lower than their 5 year equivalents. I wonder if this is a sign that some normalcy is returning to the market? Im not sure I would count on it!

Summary

With the exception of August rates are still as low as they have been in the last year or 2, possibly even closer to 4 years.

The 2 year fixes appear to be a little more steady than the 5 year fixes. We are also back to the point where 2 year rates are lower than 5 year fixes. This has not been the case since more or less the mini budget.

But importantly, although rates have crept up it is only slightly. I wrote a few months ago that I was looking forward to a steady market space, I am happy to see it is still here and I hope it continues.

If you have any questions or thoughts, please