What effect will a Student Loan have on a Mortgage?

Mortgages & Student Loans and how the two are interrelated is a common question for many young professionals and graduates and the simple answer is that a student loan, like any other loan or credit balance will potentially reduce the amount you can lend.

Most lenders would normally look at how much you pay and then put that down as a commitment so when it comes to mortgages & student loans whilst we realise that the amount is taken pre tax, the problem is that most lenders however would treat it like any other loan.

However, that being said having a student loan does not always mean it will affect the amount you can lend. It is just taken into account when assessing the affordability.

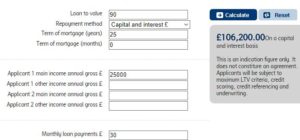

Below is an example of someone applying for a Mortgage. A single applicant, earning £25,000 a year with no debts or children, with and without a student loan and a 10% deposit. As of today, if you earn over £21,000 on plan 2 of the student loan scheme, you pay 9% towards the loan. That means on £25,000 you would pay £30 a year.

This shows the applicant with no student loan can lend £106,200.

This shows the applicant paying £30 a month towards a student loan can also lend £106,200.

It is all about finding the lender who is most suitable for your circumstances.

In the example above, it does not necessarily mean this lender will lend the most or be the cheapest/most suitable. Give us a call and lets have a chat if you want to discuss your personal circumstances in more details – as always, no sales spiel, just a chat.