Self Employed Mortgage Applicants, this includes sole traders and typically Directors of companies with around 25% or more shareholding in a company have their income assessed differently to those who are employed.

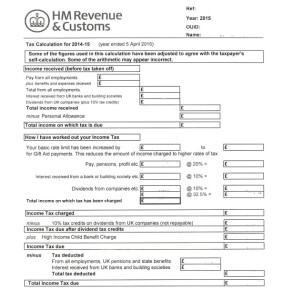

Where as employed applicants tend to use their gross annual income and provide 3 months payslips self employed applicants would usually have to provide either accounts for their business or more commonly an SA302 for the last 1-3 years (it varies depending on the lender). An SA302 is provided by HMRC following the submission of a self assessment. It is similar to a P60 in that it confirms your income for the year prior.

Unlike a P60, it confirms income from all sources – employed income, interest on savings, income from property and land, dividends, self employed income etc etc.

More information can be found here on the HMRC website.

There are 2 types of SA302s and whilst they do both contain the same information, they do differ slightly in how they appear. They differ depending on whether you obtain the SA302 online or from HMRC over the phone. An example of an SA302 is below.