Last week we were invited to an event by a mortgage lender, it was a presentation by an economist. The presentation was quite interesting and whilst I can not share the slides with you, I will share some graphs provided with some context around them.

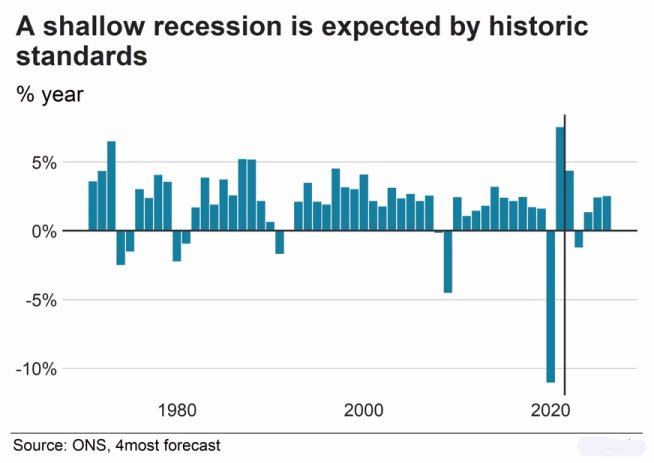

There will be a recession in 2023

Lets get all of the bad news out of the way first although with all of the news recently, hopefully that will not come as too much of a surprise. There will be a recession next year, its expected the economy will contract by around 2%. To put that into context the recession in 2008 was around 4.5%. The 3 prior recessions in the 80s and 90s were also all more than what is expected next year.

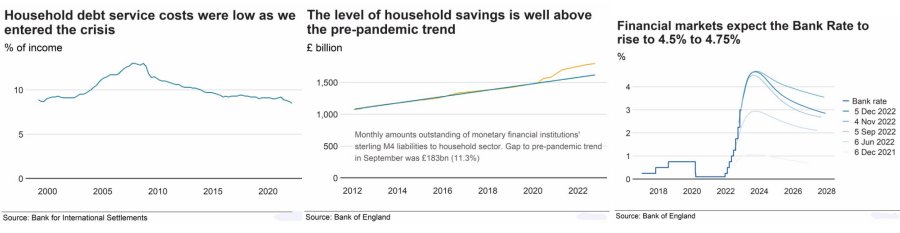

The reason is is expected to be less severe is down to a couple of reasons:

- The amount people are spending on servicing their debt is relatively low at around 8% of income. In 2008 it was closer to 15%,

- The amount that people have in savings has been increasing year on year since 2012 and is almost 50% higher than it was a decade ago (not accounting for inflation).

- Peoples overdraft balances are around 25% lower than in 2008.

- The Bank of England base rate are also expected to carry on increasing in 2023, this is in order to try and get inflation down and back under control, they are expected to peak at around 4.5% in 2024.

The good news going in to 2023

Following on from the above, in general people have less debt, it is costing less to service. In addition to that they have more in savings. All in all that is obviously great news. The flip side to this however is that the cost of living has increased significantly and that will affect peoples ability to go out and spend.

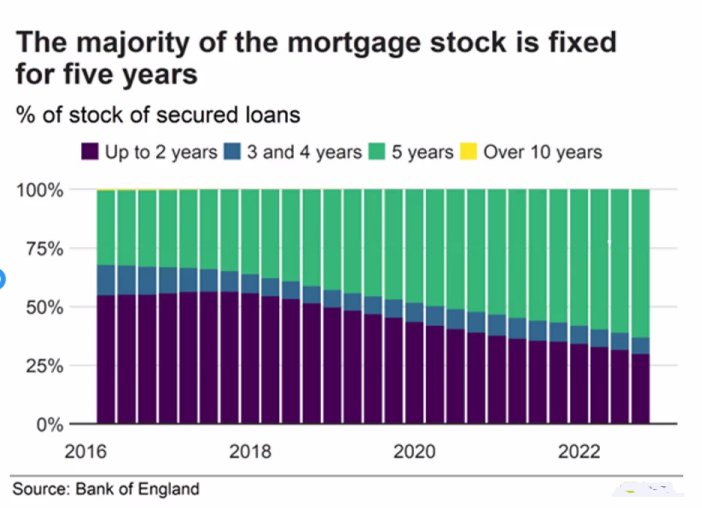

The other good news is that over the last 5-6 years, more and more people have been switching to 5 year fixed rates and away from 2 year fixed rates. With over 50% of new mortgages being fixed for 5 years since around the middle of 2021. This is also good news as it means there are going to be large numbers of people tied in at good rates. Many of these will be tied in until at least 2025.

There is also a belief that the worst of inflation is currently here. We were told it should start to come down over the coming months.

The bad news going in to 2023

Unfortunately it is not all good news, but I have covered this off earlier. It is expected the base rate will continue to increase in 2023, but most likely at a much slower level than it has done this year. That will likely carry on into 2024.

Households will continue to feel the pressures of inflation as although it should start to slow, it is not going to stop. Unless wages start to increase, this will mean more people continue to struggle.

What about 2024?

There is a belief that around mid 2024, interest rates will star to come down. That will be due to the fact that inflation should be under control more or less by then. It will also be a way for governments to try to call an end to the recession.

Summary

In short, I suppose there are 3 things I took from the presentation:

- Although things are not great for some at the moment, it is unlikely to be anywhere near as bad as 2008.

- 2023 is probably going to get a little worse than it is now.

- By the end of 2024, we should start to see some improvements in our situation.