This post is a follow on to our previous posts in

The idea for this ongoing research stemmed from there beeing a lot in the news about interest rates being up and down. What we read was confusing and/or misleading – who remembers there being mortgages under 4% earlier in the year? There were! But they were typically up to 60% LTV and came with larger fees – which in reality meant about 95% of people were either not eligible or it was not useful for them.

I thought I would do these posts on rates that would be applicable to a wider range of people, typically first time buyers or those with smaller deposits or some complications. The £999(ish) fee, some lenders may charge £800 + £199 application fee or £995. I will look to cap the arrangement fee at around the £1,200 mark just so we know we are comparing more or less like for like.

What mortgage rates we are looking at

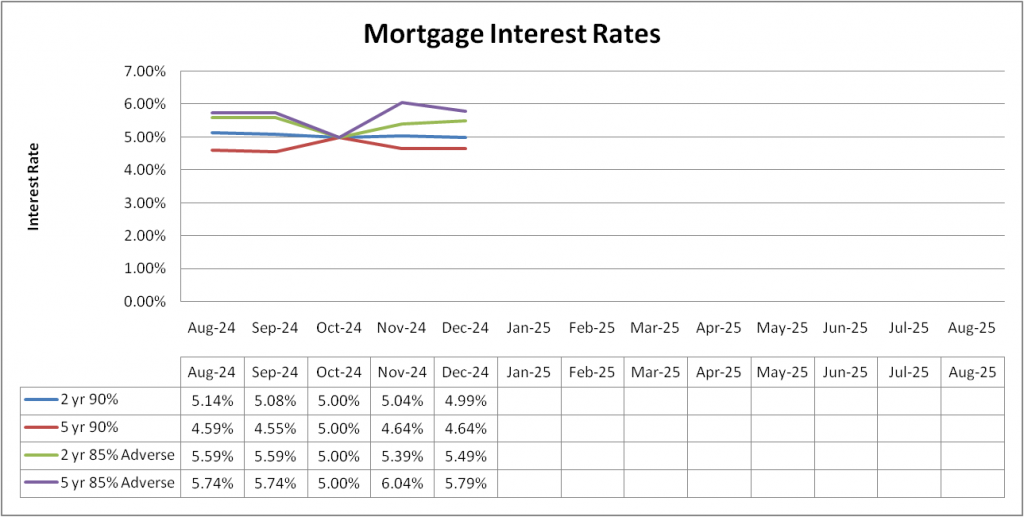

These 4 will remain the same so ensure a fair comparison. The 4 rates we are looking at are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999ish fee for adverse*

- 5 year fix at 85% LTV with a £999ish fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

What mortgage rates are available now?

I put Octobers figures down as 5% just to fill in the box.

What I think is most interesting is that although there are fluctuations, in 5 months interest rates on all 4 have changed by less than a quarter of a percent (0.25%).

What is interesting though is that the 2 year fixed rates are now lower than they were in August where as the 5 year fixed rates are higher. We can start to see a bit of a trend now we have a few months worth of rates put in.

There may be a couple of points which need to be noted. In some cases there may be cheaper products out there. However these products are only available to certain people. For example people who live in certain postcodes or are staying with your current mortgage lender. I have not included those products. I have tried to stick to products which are available on the open market to the majority of people.

For the adverse products, I have also ignored the lenders who credit score applications as realistically although it is within criteria, the likelihood of being accepted is very very low.

Summary

I have to admit, the last 3 weeks or so I have seen countless emails telling us of rate reductions. I was interested in re-running the figures above to see how much rates had come down by in the last month.

To see how little it was cought me by surprise! I was expecting to see a little more than it had been. It seems like a lot of work involved tweaking interest rates by what is seemingly a very small amount.

In Novembers update I did say I do not think we will see much happening with interest rates, which does seem to be the case. It was just the amount of emails coming through advising of rate reductions which threw me.

And this goes back to the reason why I started these interest rate updates… What you read in the news and elsewhere can be confusing. It does not necessarily tell the full story.

Thankfully you have Mortgage Success on your side cutting through it all to be as transparent as we can be.