This post is a follow on to our previous posts in

August and

Unfortunately due to being very busy last month we missed Octobers update.

The idea behind these posts is that there has been a lot in the news over the last year or so. We have heard rates going up and down and under 4%. But I do not think that tells the whole story. The rates under 4% initially as an example were at 60% LTV and came with a large fee. That meant for most people they were not much use.

I thought I would do these posts on rates that would be applicable to a wider range of people, typically first time buyers or those with smaller deposits or some complications. The £999(ish) fee, some lenders may charge £800 + £199 application fee or £995. I will look to cap the arrangement fee at around the £1,200 mark just so we know we are comparing more or less like for like.

What mortgage rates we are looking at

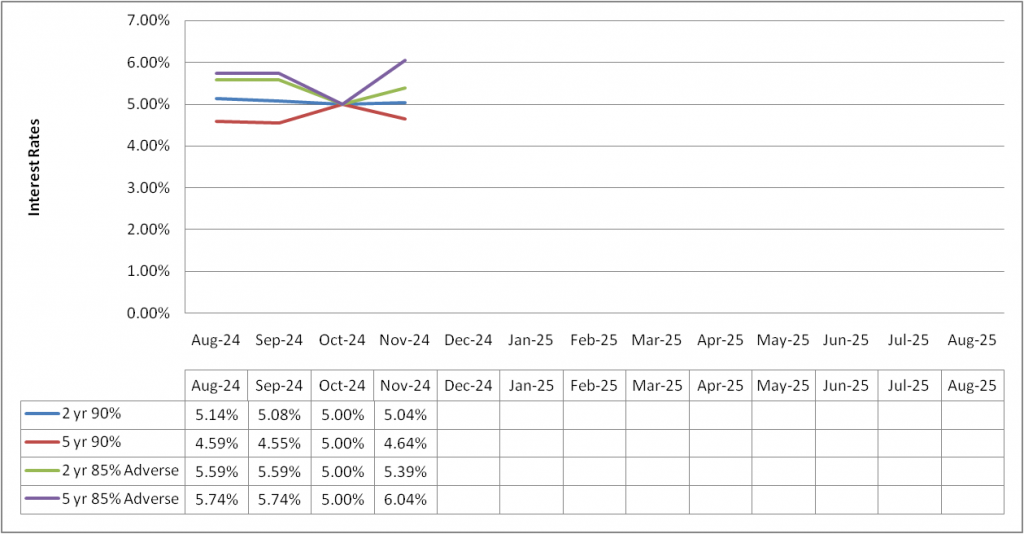

These 4 will remain the same so ensure a fair comparison. The 4 rates we are looking at are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999ish fee for adverse*

- 5 year fix at 85% LTV with a £999ish fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

What mortgage rates are available now?

I put Octobers figures down as 5% just to fill in the box.

That aside, as you can see from the table below, there are some slight changes but again nothing significant. The adverse rates are staying fairly steady some up, some down which is probably partially down to the budget and how busy lenders are. Sometimes they tweak their rates up or down depending on business volumes.

The 5 year adverse is the biggest change. I think this is down to small lenders who were maybe leading rates in the adverse market pulling their products which created a bit of jump. It will be interesting to see if those products come back and what effect that has on the market. It could just be a bit of an anomoly at this stage…

There may be a couple of points which need to be noted. In some cases there may be cheaper products out there. However these products are only available to certain people. For example people who live in certain postcodes or are staying with your current mortgage lender. I have not included those products. I have tried to stick to products which are available on the open market to the majority of people.

For the adverse products, I have also ignored the lenders who credit score applications as realistically although it is within criteria, the likelihood of being accepted is very very low.

Summary

Up until I started these tables interest rates were edging down. Nothing significantly but over the course of the year they did start to mount up.

They appear to have levelled off. I think they may have carried on coming down slightly but the budget seemed to give the money markets a bit of a wobble. I also think we are now at the end of the year, this is the point where one of 2 things happen, lenders have hit target and so take their foot off the gas or they are behind and so try to make up time. It seems mortgage lenders are quite happy with their numbers for the year.

I suspect December will be fairly similar. January or February could be next interesting update as we will see if lenders are wanting to hit the ground running or happy to see how it plays out.