Dont worry, this is not one of those posts where I say we are the best, everyone needs a mortgage broker and we will find you the best deal.

I wanted to delve into why you might find a mortgage broker beneficial. So lets just get this out there, we are not a price comparison service. You do not need a broker to find the cheapest deal! Anyone can do that using the internet.

Chances of mortgage being accepted

I could not find any statistics on this which is a bit of a shame as I would like to think the chances of being accepted via a broker are better, let me explain why…

As an employee of a bank, you get paid regardless. I have a real life example of where a client went to his bank and was declined. We applied to the same bank less than 2 weeks later and had their mortgage agreed.

As a mortgage broker with 80+ lenders we receive training from many of those companies. Every now and again you learn little tricks of the trade on systems on how to help an application proceed. Sometimes those hints and tips can help to gain you a few extra points here and there and help your application get over the line. Now clearly if you have 10 defaults from last month trying a bit of wizardry is not going to help. But it might make a difference on a borderline application.

I cant back this up with any statistics, so I could be wrong. But I would like to think we receive training from many of the banks rather than just one. So we know a lot more about a lot more.

Our systems

Rates

As I mentioned earlier, we are not a price comparison service. However, that being said, it does not mean we can not help to find you the cheapest deals. We have a system (which we pay for), this pulls up all of the products from all of the lenders we have access to. It is updated twice a day, it allows us to switch between fixed and variable rates, different tie in periods, allows us to add up the total cost over the initial period and more.

This is great as it is ensures we are not just making a recommendation on rate but total cost. It is not uncommon for people to get drawn in by the rate, but the fees will also have an effect on the total cost – especially true on smaller mortgages.

Affordability

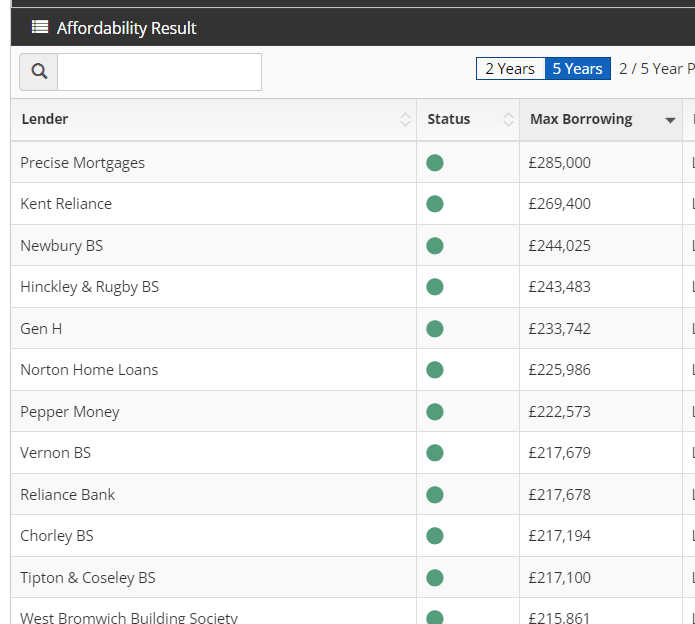

Another system we have is to help us check affordability and whether in the eyes of the lender you can afford the mortgage. Finding a rate is one thing, being able to get it is very different. One of the things we have to check with regards to eligibility is affordability.

This system is not 100% accurate so we still have to manually check afterwards to be safe. The system we use allows us to check with many lenders how much you can obtain quickly. In the example below there is a lender who is £15k above the second, who is £25k above the next.

Its at this stage we can start to narrow down the absolute maximum you can get – but it might come at a premium. We can start to have a conversation about whether you want the best rates or do you want to max out lending?

Criteria

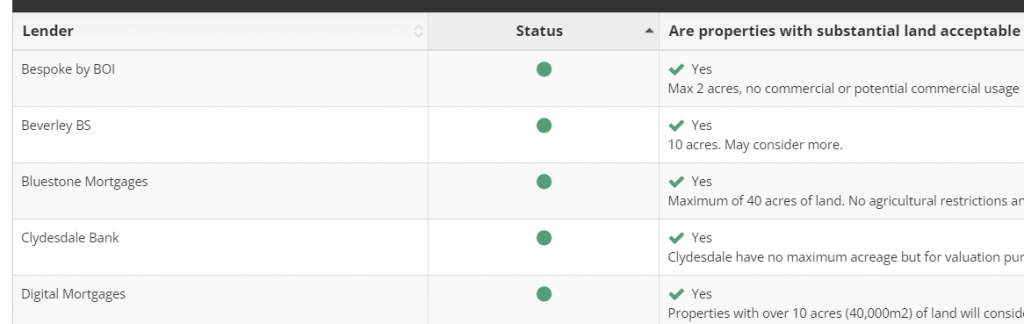

Another system we have is the ability to narrow down on criteria. In the image below I was researching a case where the property had a lot of land with it. What I found quite interesting was that alphabetically 4 of the first 5 lenders all had completely different figures. The acreage allowed varied with 2 acres, 10 acres, 40 acres and no maximum! That is a huge difference – literally!

The systems we use can also be used to look at adverse, income types (benefits, self employment), the property and so on. We are not just checking to see if you are able to get the mortgage but also if the property is likely to be accepted.

Knowledge & Experience

With all of the above information we can start to narrow down how much you can obtain, what the rates will look like and the overall cost of the deal. We can do that using all of the systems we have that we pay for and rely on. I am not suggesting what is available online is any less accurate but I would like to think what we have is as accurate as it can be.

Speaking of myself personally, I became a mortgage broker in 2011. I have worked for 2 banks and a life insurance company. All in I have been in financial services since around 2004 and have a lot of experience as a broker and plenty of experience of what it is like behind the scenes with the lenders themselves.

Solicitors & Estate Agents

Estate agents can be hit and miss. Some are lovely throughout, some are lovely until your offer has been accepted. Once that happens they can then become quite pushy.

As we have been working with estate agents for many years, we can take that pressure away from you. My general line here is that you are in work during the day. Our job is to deal with the mortgage. We can work with the agents whilst you are in work and then update you once out.

The same can be said for solicitors also to an extent.

Summary

In short, you are not getting a price comparison service. You are getting someone to find you the better deals but most importantly ensuring you also get the mortgage at the end of it. If there are any problems along the way, you have someone to fight your corner.

We have a lot of software and experience on our side. This helps to ensure you get from start to finish as quickly and efficiently as possible.