Getting a mortgage can be either very easy or very difficult and everything in between. We have had mortgages where we have had mortgage offers issue faster than it takes to play a game of football through to taking longer than the euros!

As most people want their offer issued sooner rather than later, if nothing more than to not have to worry about it, I thought it would be a good idea to put some top tips together to help you improve your chances of getting a mortgage.

1. Check your credit report(s)

I dont think I can explain how important this is. We now ask all customers for a copy of their report. The amount of times people think they have no negative markers only to find they do is surprising. It can vary from forgetting about a £12 default through to being completely unaware of a CCJ as it went to your student house.

So to save time, it is easier to get a copy of your report. You can get a copy from any of the providers – equifax, experian or transunion. Or you can go to CheckMyFile which will give you a copy of all 3 reports.

2. Make sure your addresses & Information are correct on there

Carrying on with the Credit report theme, make sure everything is correct. That means, putting in your address history (and not missing off the student house because you were only there for 12 months). If you spot any mistakes, get on to the credit agencies and the providers to correct it.

The time to do all of this is before you put your application in as it can take a few weeks to get altered and a month to update, so getting on for 2 months.

3. Check your bank statements

Imagine you were an underwriter, what would you look for to see if the applicant is a good risk? When we look at bank statements, we are looking for things like:

- Being overdrawn a lot,

- Gambling,

- Bounced Direct Debits,

Although this is not a definitive list and even with those things it does not mean you can not get a mortgage – it just gets put into the table like above.

4. Get your documents together

There is no definitive list as everyone is different but here is a bit of a starting point:

- 3 months payslips,

- 6 months payslips (if we need to use bonus or overtime etc),

- 2 year tax calculations and tax year overviews (if self employed),

- ID,

- Proof of deposit if a purchase,

- 3 months bank statments for all used accounts.

Over the years we have also needed marriage certificates, where you have recently got married and not updated your name on ID/bank accounts or in one exception we also had to get extra bank statements and a letter from Camelot for a lady who had had a lottery win!

5. Ensure you fit criteria

This can be an interesting one, I have spoken to people who think they are straight forward before now but actually due to one “minor” issue, it can mean they do not have access to certain lenders or many lenders. Here are 2 good examples – First time buyer success story and Short term contract success story. These 2 examples are about fixed term contracts, but interestingly one had picked up on the problem beforehand, but the other applicants had not.

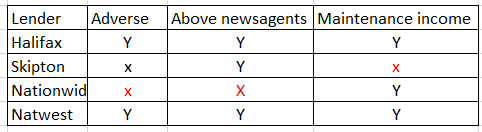

You can see what goes into our research here. But as a very brief overview, when we go through your case we draw up a list of any issues and we make a table like the one below. This is useful as it means when we call or email lenders, we can check everything in one go.

6. Ensure you fit affordability

This is another one that can either be quite easy or quite difficult to check. Most high street lenders use ONS figures for affordability (with the exception of commitments – loans, credit cards, maintenance etc).

If you have adverse, or another complication that means you do not have the pick of lenders you may need to go to a lender who assesses affordability manually. This means they will go through your bank statements line by line and everything gets assigned to something – those daily coffees, they probably get lumped with drinks down the pub in entertainment for example.

Income, again this can also be easy or difficult. If you are on a set wage, nice and easy. If you need to use bonus or commission income or benefits, it does start to get more complicated. This part could also have been lumped with “check you fit criteria”. Some lenders will not use any benefit income, others will have rules around it. Likewise with bonus and commission income, its a case of ensuring you are calculating it the way the lender will to ensure you get the same result.

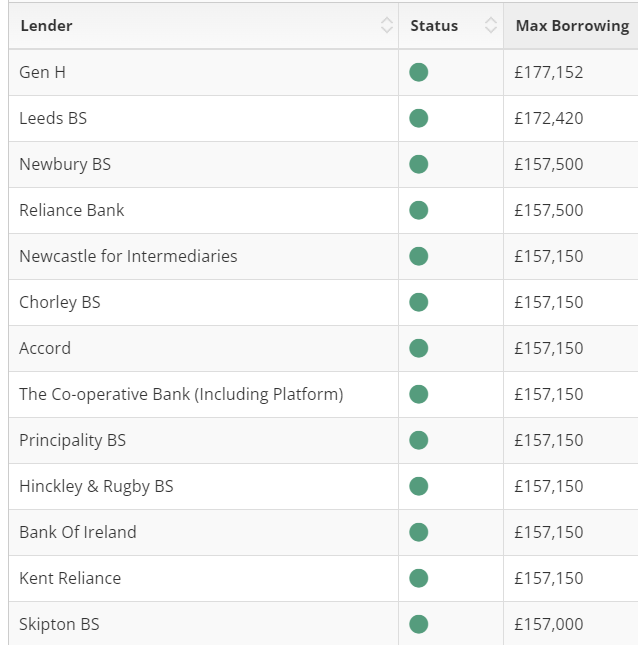

Just in this one example, there is £20k difference between the first and 13th lender, we have access to over 80 lenders so you can imagine the difference can be signfiicant.

7. Use a broker

Obviously I could not end these top tips without suggesting you use a broker. I say this party as a joke, but not completely.

A lot of people see a broker as a price comparison service. That is FAR from the case. Last week I was on the phone until gone 7pm one night with 2 applicants crying. I sat there and let them unload all of the problems and worries on me. We then discussed how we would proceed and how we I was confident we could get them a mortgage and so on.

I joke about a lot of my job, but I realise customers just want to use my body! (are you ready for some corny stuff?)… Some people want their hand holding and to be guided on the process and how it works. Others are so relived they just have someone to talk to to explain the previous problems and how they are not bad people (thats the ear part of my body btw) and other people like knowing there is someone at the end of the phone on their side whose brain they can pick with any questions along the way.