This post is the January update to our monthly review on what is happening with mortgage interest rates. You can see the previous months here:

I do these monthly posts as there is a lot in the news about interest rates and the base rate being up and down. What I read was confusing and/or misleading and we are mortgage brokers! Who remembers there being mortgages under 4% last year for example? There were! But they were typically up to 60% LTV and came with larger fees…

This last month has seen a LOT of news about rate reductions following the bank of england base rate reduction. The example I mentioned above, that has just happened again in the last week or so. I was quite interested to do the numbers this week as I lost count of the number of emails regarding rate changes (both up and down). I read a lot in the press about the base rate and in turn mortgage rate changes.

What mortgage rates we are looking at?

I have looked at 4 types of mortgages. Mortgages that I think would appeal to a wider range of people than 60% LTV with a large fee!

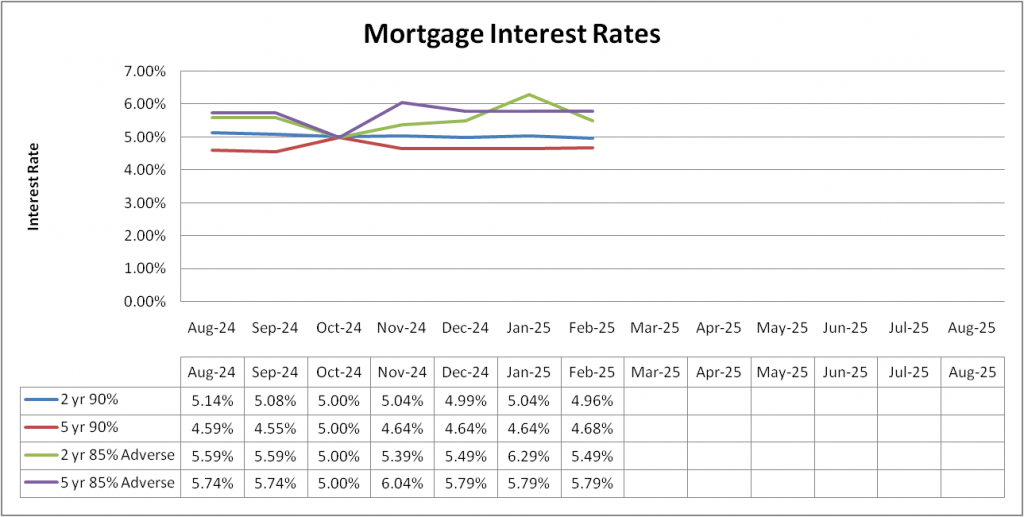

These 4 will remain the same so ensure a fair comparison. The 4 scenarios we are looking at are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

What mortgage rates are available now?

*October update I missed which is why its skewed that month.

Over the last 7 months interest rates have remained fairly stable. This is despite all of the doom and gloom we read about the economy and bonds, gilts etc.

Last month there was a jump (the green line) in one of the areas. Th explanation I gave last month I gave the explanation for that being the lender who had been cheapest for the last few months had pulled their products due to being busy and that if they returned, the rate would drop again – which is what has happened.

Taking that out of the equation, rates have remained fairly stable. The 2 year fixes are slightly lower than when we started to record the numbers, the 5 year fixes are slightly higher. I am not really sure what conclusions to draw from that other than really rates are fairly stable.

Other than that, it is business as usually, those rows could not be any steadier if you tried! And this is exactly the reason why I wanted to do this.

There are a couple of points which need to be noted. In some cases there may be cheaper products out there. However these products are only available to certain people. For example people who live in certain postcodes or are staying with your current mortgage lender. I have not included those products. I have tried to stick to products which are available on the open market to the majority of people.

For the adverse products, I have also ignored the lenders who credit score applications as realistically although it is within criteria, the likelihood of being accepted is very very low.

Summary

The recent Bank of England base rate reduction generated a lot of interest and excitement, more so than I have seen in recent years. But from a Mortgage perspective, there has not been any real change.

After the last few years, as much as it would be nice to see lower rates, I will happily take a steady market which is what we seem to have. Hopefully the dust will continue to settle and there will be no drama for a little while longer.