Earlier this month whilst doing some research for a client with adverse, I was going through the products on our sourcing system. I came across a lender where their “level 2” products were being displayed.

They were on page 2 of the results (about 25th on the list). This was a little surprising as I was expecting them to be a little higher up the list based on their rates. I was a little confused and went over the notes I had taken and how I had keyed everything on, initially I thought I had made a mistake.

However, the mistake was down to IT limitations. Our mortgage sourcing system only asks about the date and the amount of the default. It does not ask about the type of default. This is important as it can make a big difference.

Some lenders will ignore defaults under a certain amount or if they are for certain things. Some lenders will ignore mobile phone defaults, other lenders may ignore utility bills for example and others might ignore any defaults under a certain value.

The adverse

This couple had 7 defaults between them. 5 of those defaults were registered over 3 years ago. This meant there were a few lenders who would ignore those defaults as they are only interested in the last 2 or 3 years.

The other 2, one was for a mobile phone (which some lenders ignore), it was also £154 which meant some lenders would ignore it on its value. The last default was for a credit card and was for around £250. This meant some lenders would ignore it but not all.

The problem with our sourcing system was that it was only displaying lenders who would accept the defaults based on their values and not including the lenders who would ignore them for other reasons.

This is where we can add some value…

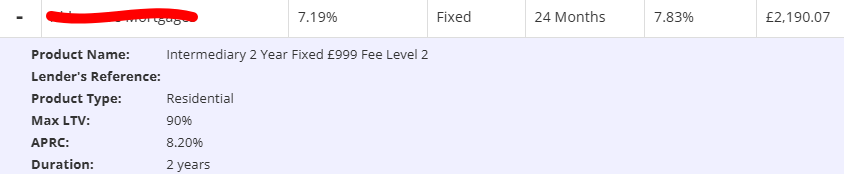

I knew from the products being displayed that something was not quite right. I looked into it in a little more detail to see where we were going wrong. Fairly quickly I was able to see that for this particular lender, we should be looking at their “Level 1” products rather than level 2.

We were actually able to get a rate of 6.64% which was around £120 pm less. That is nearly £3,000 less over the 2 years than the displayed products with the same lender.

However because the sourcing system was not displaying the lower rate products, we would never have even looked at them if we were solely relying on our sourcing system.

Would a general mortgage broker have picked up on this?

I imagine some might have, but as a general broker I think the majority would have missed it.

Around 70% of our mortgages involve adverse. But only around 35% end up with an adverse lender.

That is important. It shows that only around half of the adverse mortgages we do end up with a specialist adverse lender. The rest will end up on the high street or somewhere close to it.

There will be advisors with limited experience of adverse who will plug the numbers into the system and let the system tell them who to apply to. To us this is not how a mortgage broker should work. We use it more as a guide to show the products available. But we do a lot of training with lenders specifically around adverse criteria.

We do this because it gives you a reason to use us over any other broker. Adverse lenders are more work. If we can avoid them it is better all round. It is less work for us, cheaper for you – everyone wins.

Let us be your secret weapon.