The answer to this question is one of those where the details really do matter. There are lenders who will sit down, talk to us about an application and take a holistic approach to you as a person.

There are also lenders where you can put a good application in front of them, it might fall out of criteria on a technicality but they can take a view on it.

Which can lenders manually underwrite?

When talking to customers about their potential options, I always say there are 3 types of lenders:

The high street

The high street is usually where the cheapest products are – but there are exceptions which I will get to shortly. Generally speaking these are the big banks that you think of. However it does also include a couple of building societies who are able to compete on rates. It is unlikely they will manually underwrite an application. However there are times where we can get exceptions made if it does fall outside of criteria.

Building Societies

These are smaller regional lenders. Some will only lend in certain areas, others will lend throughout the UK. Building societies are usually a little more expensive than the high street, but not always. The smaller building societies tend to be more flexible when looking for manually underwriting.

Adverse or Specialist lenders

A little like banks, they tend to stick to their criteria quite stringently. Although in some places their criteria can be a little more relaxed than the high street. However they are going to be more expensive than the high street and building societies in general.

What do you want manually underwritten?

This is a really important question as this will determine what can be done.

Adverse – Generally speaking with adverse, if you need manual underwriting, you would be looking off the high street. The high street can accept some minor adverse, but there is usually little room for manoeuvre. We may be able to get them to look at a £505 default if there maximum on paper is £500. But thats about their limit.

Affordability – The high street tends to be prepared to lend the most in the majority of cases. However there are examples where building societies will assess your income based on your actual expenditure which may go in your favour.

Employment – Many lenders can be flexible with employment in the right circumstances. The right circumstances will vary from lender to lender, we have lenders who are good with fixed term contracts, professionals, newly qualified, or new jobs. But its a case of finding the right lender for you.

The property – We made a post recently on quirky properties. They varied from properties with water from a borehole to windmills! Similar to employment, there are 80+ lenders and many of them will look to accept something outside the norm in the right circumstances.

Something else… This is a catch all really. The devil is in the detail and so what you need will dictate who the best lenders are for you. A good experienced broker can help with that.

How much more expensive

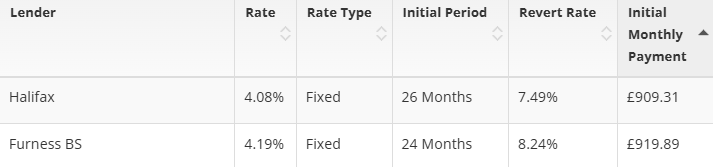

Below are 2 examples based on a £170k mortgage over 25 years. You have a high street lender – which in this case is Halifax who were coming out the cheapest on a 2 year fix. We then have Furness who were the cheapest non high street lender who can be flexible in certain circumstances.

Going back to the original question of whether or not manual underwriting is more expensive, in this case it is. But we are talking about £10 pm more expensive. So, yes it usually is. But not significantly so.

Using the right lender for the right circumstances

I am sure if you are looking for a manual underwriting lender, your first instinct will be to go to Furness as they have good rates going off the image above. But it is important to check that you have the right lender for you.

Furness can be quite good for certain things – large amounts of land for example. However there are other areas where they are not as flexible. Also their competitive rates do come and go, as they do with all smaller lenders.

Not wanting to turn this into a salesy post, but it is worth speaking to a broker if you are not quite straight forward and need some sort of manual underwriting. We build relationships with lenders over many years. We learn what they like and do not like and where they can bend their own rules.