There has been a lot in the press recently regarding Mortgage Prisoners and how to Help Mortgage Prisoners.

This in the main came about following the recession where our governing body (the Financial Conduct Authority or FCA for short) decided to tighten up lending rules in order to try and prevent or reduce the effects of what happened following the recession in 2007 from happening again.

Whilst the rule changes made were made with good intentions, they were probably not thought out as thoroughly as they maybe could have been. The rules in part basically state medium and large lenders can lend no more than 4.5x income to 85% of their customers. The idea there being that it gives lenders some scope to lend beyond 4.5x income for times where it may make good business sense, an example could be a Doctor who generally speaking will receive significant pay rises during their first 5 years of qualifying.

There has been some news recently where the FCA has said lenders can relax their affordability checks for customers who have evidence of paying a mortgage at a higher rate. However, this has not really filtered through yet and in the main lenders appear to be reluctant to lend beyond what their affordability calculators say.

There could be a number of reasons for this, one of which is that, where lenders can lend a maximum of 4.5x income to 85% of their customers. That could mean these mortgage prisoner cases eat in to that 15% and so it would probably not take a lot for them to go over what they are allowed. It could also be a case of them not wanting to take the risk when there are “better” risks for them to take.

This all sounds bad doesnt it? We have taken a slightly different view to what you may have read in the press. I have explained more in the “What can I do if I am a Mortgage Prisoner” section below.

- What is a Mortgage Prisoner?

- GE Mortgage Prisoners

- Tesco Mortgage Prisoners

- Magellan Mortgage Prisoners

- Secure Trust Bank Mortgage Prisoners

- What can I do if I am a Mortgage Prisoner?

- How can we help?

What is a Mortgage Prisoner?

A mortgage prisoner is someone who has a mortgage which was taken out in the past and is now unable to remortgage elsewhere or with their current lender on to a competitive rate. Some lenders do not offer retention products, so that could mean when you come to the end of your deal, you are stuck on the lenders variable rate which is not usually competitive and could be in the region of 5% where as most mortgages in todays world are closer to 2-3% if you are tying in to a new deal.

There could be any number of reasons for that, your original lender may have decided to pull out of the market and not offer any more new deals, your Mortgage may have been sold on to a company who just manages the “book” of customers down or it could be that your circumstances have changed and you are no longer able to pass the checks needed in todays market.

Who is your Mortgage with?

There are a few lenders who you may have a mortgage with that will make you more likely to be a Mortgage prisoner. This is because their checks were possibly more relaxed in the past with those lenders or they were a fairly large lender that no longer offers retention products and so it is more likely you were one of their customers than that of another lender. We have written a brief overview on some of the more likely lenders you may be stuck with, however there will be other Mortgage lenders not listed.

GE Money Mortgage Prisoner

GE Money were one of the first lenders to return for applicants who had credit issues in the past following the recession in 2007. However in 2014(ish) they pulled out of the Mortgage market and no longer offer Mortgages. That could mean you have historic credit issues that may still be showing or new credit issues since then. However it does not necessarily mean you need to be stuck with GE money and we can look at alternative options for you potentially at better rates than their follow on rate.

Tesco Mortgage Mortgage Prison

This is unlikely to be an issue at the moment, but Tesco Mortgages came to market in 2017ish and took on around 23,000 customers. As they have now closed their Mortgage operations and are looking to sell it, you could find you become a Mortgage prisoner in the future. This is something we could look to help with to try and ensure you do not end up stuck on an deal that is not competitive when your initial rate comes to an end.

Magellan Mortgage Prisoner

Magellan were a very specialist lender in that they very much geared themselves to customers who had some significant credit issues in the past. If you are a Mortgage prisoner with them, it is quite likely it is because you have had historic adverse. As we do a lot of bad credit, I would like to think this is something we are quite comfortable helping out with so hopefully your historic credit issues will not make you a mortgage prisoner.

Secure Trust Mortgage Prisoner

Secure Trust bank were another specialist lender, although they were more geared towards self employed applicants with very highly qualified underwriters who were good at looking at company accounts and understanding them. They were prepared to make allowances for good accounts. You could find that if you are with Secure Trust it is because you have limited accounts or complex accounts or a very good accountant.

As you can see from the above, it is possible to become a mortgage prisoner for any number of reasons – lender closing down, bad credit, self employed, change to circumstances and so on.

What can I do if I am a Mortgage Prisoner?

Well… The good thing about our industry is that every lender is different and every affordability calculator is different. Where one lender or even 20 lenders may not lend the amount you need, as a Whole of Market Mortgage broker, we have access to over 80 lenders and there may be one in that group who will.

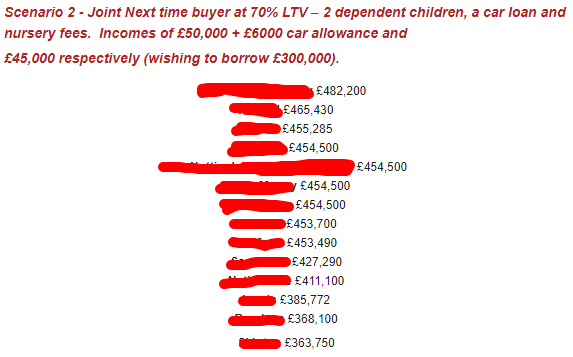

Here is a list of lending amounts from a handful of lenders for the exact same case, you can see from this that the lending amounts vary and can vary by over £100,000 for exact same scenario.

How can Mortgage Success help?

We have lenders who can lend up to 6x income, we have lenders who will take a manual approach to underwriting – this can mean if we can evidence you have been paying an amount each month, then it is feasible you can pay a lesser amount to them each month without too much trouble.

The key thing is that you do need an income and you can not be in negative equity. If your income is a little shy of what is needed, we can potentially overcome that, if your income is £10,000 and your mortgage is £100,000 then we are not going to be able to do it – so it is a case of understanding your situation and what you are looking for. There also usually needs to be some equity although it could be possible to go up to 100% LTV. Being in negative equity is one of those things we would not be able to overcome in the current climate.

Can we help Mortgage Prisoners?

Yes we can potentially help Mortgage Prisoners. There are things we can do to try and increase your lending capacity in order to help you move on from being a Mortgage Prisoner so please do get in touch and we can discuss your circumstances.