We have been producing Mortgage Capacity reports since 2019. The first time we were asked for one by an existing client we were a little stumped. We put something together but it did not include everything required.

With some guidance from their solicitor, we were able to get it to the point it was acceptable. Over the next year or so with feedback we received from other solicitors we now have what we class as our final version.

What is a Mortgage Capacity Report?

A Mortgage Capacity Report is an assessment of your circumstances prepared by a regulated whole of market mortgage advisor. It evaluates your income, outgoings, credit history, and other relevant information to estimate the maximum mortgage amount you could realistically obtain.

How do I get the report?

Firstly we would ask you to complete a factfind. This is the document we use for the research. It asks for information such as:

- Income,

- Commitments,

- Dependents,

- Credit problems,

- Age and retirement age.

Once we have the completed factfind, we can then go off and conduct the research. This is typically the bit that takes the longest as we have to not only check the affordability of multiple lenders, we also have to cross reference it with the information they require – for example some lenders may accept only a percentage of benefit income or overtime.

Once we have the figures we then start to write up the report for you.

What is included in the Capacity letter?

This is the bit that when we started our we were unaware of. We assumed it was just the highest number. However that is not the case.

In order for the letter to be accepted by the courts it needs to contain certain information:

- A maximum lending amount on Interest only,

- A monthly repayment for the figure above,

- A maximum lending amount on a repayment mortgage,

- A monthly repayment amount for the mortgage size.

- What sort of deposit is required for those amounts.

However, in the early days we would see some push back from the other side as they disputed the amounts, so what we also do is provide a brief summary of your details that those figures are based on – Your income, the term, your commitments. This has worked really well in that we no longer receive any push back, or at least very rarely. This should then mean less legal fees and time wasted arguing over the figures provided.

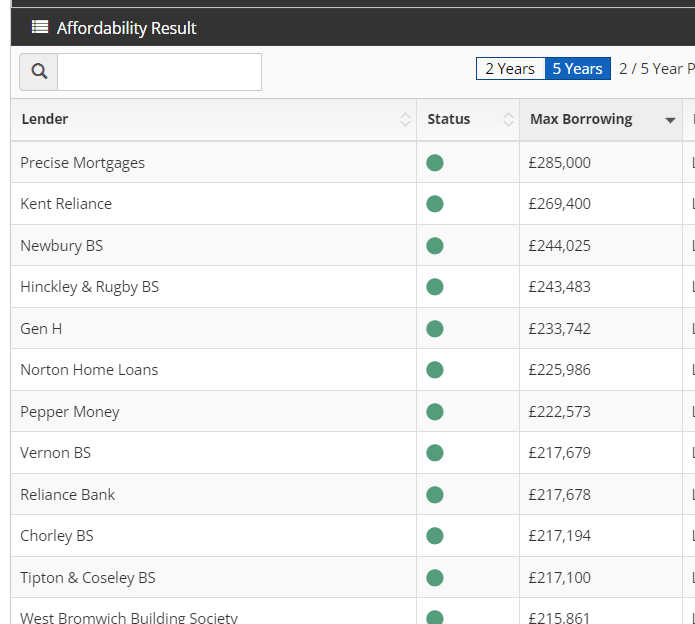

You can see from the image below that the lending amounts can vary significantly. We would also filter out any lenders we do not believe you would fit criteria with or who would be unsuitable for you.

There are a few other requirements but ultimately when we provide the letter we include everything required to ensure it is acceptable for the court.

How long does it take to get the letter?

We normally ask you to give us 48 hours once you have sent the factfind to us. This just gives us time to do the research and ensure everything is correct. We can do it quicker, but it would come down to the number of mortgage applications we have going on at the time.

And how much does it cost?

We have never increased our prices on this. We charge £199, there is no VAT to be added and providing you include it in the initial fact find or phone call, we can include various options on the same letter for the same price. As an example you may not knock how much child maintenance will be paid/received, so we can include a couple of options to help with the decision making.

Summary

We have been writing these Capacity letters for 6 years now. Based on feedback from various firms of solicitors we have something that is solid and is unlikely to get any pushback from the other side.

This should help to keep things progressing and hopefully help to reduce legal bills!

If you have any questions or would like to discuss this in more detail, do please get in touch.