I wanted to do an article on how with adverse the devil is in the detail. This is a term I use a lot and its because the details really do matter.

I speak to a lot of people who say they have really bad credit and they know I wont be able to help but they are just giving it a try on the off chance. Peoples versions of bad credit really do vary. We have some customers who do have bad credit but see it as minor due to there being no CCJs and others who think a couple of late payments are the end of the world.

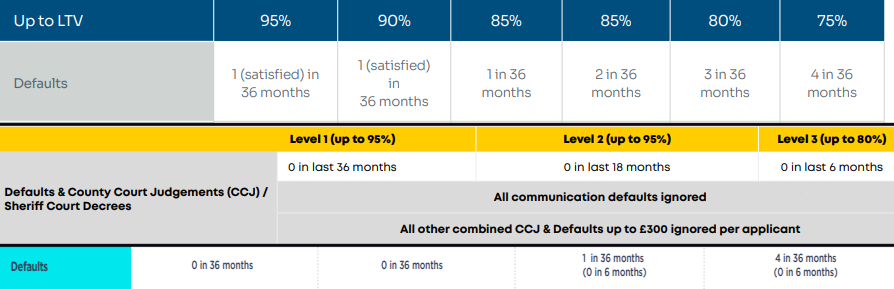

I thought it would be a good idea to have a table with some basic details on for Defaults for 3 lenders.

| Ignored Defaults | £500 Utility Default | £1,200 phone Default | £1,200 Loan Default |

| Lender A | x | Y | x |

| Lender B | x | Y | x |

| Lender C | Y | Y | x |

| Defaults in last 2 years | 2 | 4 | 5 |

| Lender A | 95% LTV | 95% LTV | 95% LTV |

| Lender B | 85% LTV | 75% LTV | x |

| Lender C | 95% LTV | x | x |

| Defaults over 3 years | 2 | 5 | 10 |

| Lender A | 95% LTV | 95% LTV | 95% LTV |

| Lender B | 90% LTV | 90% LTV | 90% LTV |

| Lender C | 95% LTV | 95% LTV | 95% LTV |

The customers

| Customer 1 | 2 Defaults registered 2 years ago. 1 is for £1,250 for a phone 1 is for £500 Utility bills | Lender A – x Lender B – x Lender C – 95% LTV |

| Customer 2 | 7 Defaults registered 3 years ago 5 are for Credit cards £1,000 each 1 Water bill £200 1 Gas bill £300 | Lender A – 95% LTV Lender B – 90% LTV Lender C – 95% LTV |

| Customer 3 | 3 Defaults registered 2.5 years ago All 3 are for mobile phones | Lender A – 95% LTV Lender B – 75% LTV Lender C – 95% LTV |

Some thoughts

These examples are limited. I have tried to simplify the criteria and use a limited number of lenders so you can see how the details to matter.

Lender A – They went from lending nothing in scenario 1, through to 95% in 2 and 3.

Lender B – Their LTVs were all over the show compared to the other 2 lenders.

Lender C – Were consistently at 95% LTV.

What is interesting is that for Customer 2, I suspect Lenders A and C would probably decline that customer. On paper, they would go up to 95% compared to Lender B’s 90%, but I think Lender B would be the most likely to accept them.

It doesnt mention that in the criteria anywhere though. Knowing whether you are likely to be accepted is one of those things that only comes with experience.

What does this mean?

We have access to over 80 mortgage lenders. Some will not touch adverse, others will go up to 95% LTV. What they will and wont accept is very hard to put into a table like the above as there are usually other caveats, none in the last 6 months, underwriters discretion, was there a life event (ie did all of the adverse happen at the same time or was it over a prolonged period – 7 defaults 3-5 years old might be treated differently to 7 defaults 4 years old).

Here are a couple of examples of how the details matter.

What do we do?

In short our job is to sit down and look through your credit report. I tend to put together a table of all the adverse. I then work through our list of lenders and draw up a short list where the adverse fits. From there I exclude any lenders I think are likely to decline based on past experiences and then we go from there.

I made a post on how we do our research here. Its only a basic overview as a lot of our time is spent calling account managers and waiting for call backs. But you can get an idea of what goes into it.

Summary

The examples might not be the best, but you can see how the slightest change to your circumstances can make a difference. It could be a case of holding fire for 6 months, it could be a case of needing a larger deposit. It might be a case of that we can do it now, but it will cost a little more.

Or as happens on some occasions, you might just get really lucky and everything just fits. But we will only know that by looking at your credit reports and taking into account the details.