This post is the March update to our monthly review on what is happening with mortgage interest rates. You can see the previous months here:

Q4 2024 – October was missed, November, December

Q1 2025 – January, February, March.

I do these monthly posts as there has been a lot in the news about interest rates in recent years.

I found it confusing and I am a mortgage broker! It was quite frustrating to hear how interest rates are now under 5%, 4%, 3% etc, but the reality is that most people would not have been eligible for those products. Typically they were only eligible for people with 40% equity or a 40% deposit. And even those who were eligible may have been better off paying a higher interest rate as they usually came with high arrangement fees.

I am quite quite interested in doing this months as there has been a lot that has happened in the last month. The US announced tariffs, then they announced even bigger tariffs, then they rolled some of them back. In the news I have read that mortgage rates will drop due to these tariffs from major news sites such as the BBC here, I am sure you have read similar.

So lets see what has actually happened on the products we review…

What mortgage rates we are looking at?

I have looked at 4 types of mortgages. Mortgages that I think would appeal to a wider range of people than 60% LTV with a large fee!

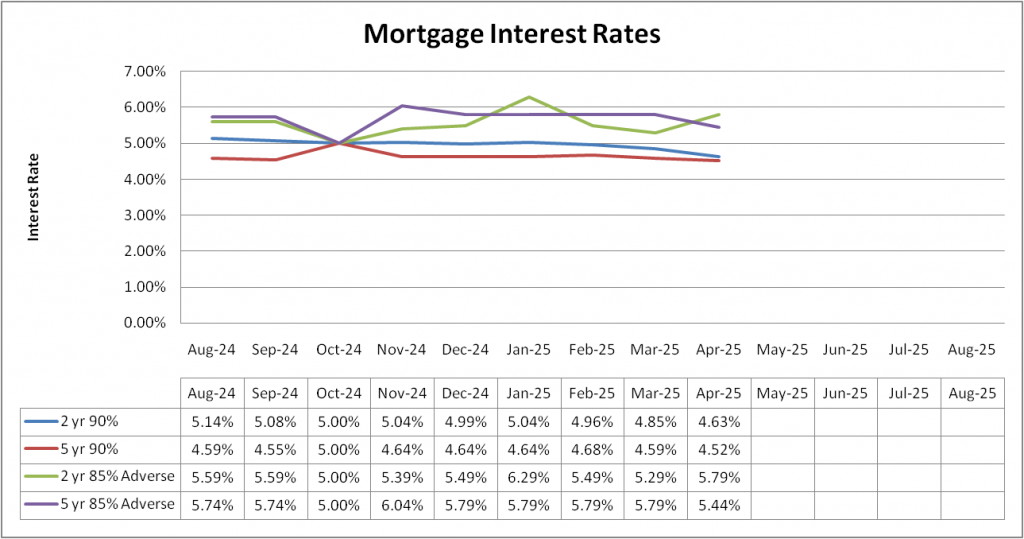

These 4 will remain the same so ensure a fair comparison. The 4 scenarios we are looking at are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

What mortgage rates are available now?

*October update I missed which is why its skewed that month.

There does seem to have been some noticeable differences this month.

Lets look at the green line first as that one stands out. In the adverse world, lenders are typically smaller and there is less competition. In the case of this lender there has been 2 building societies who have been leading the market with their rates. As with the spike in January, I suspect this is down to lenders pulling their products (probably because they are busy) rather than it being an actual rise in rates. I imagine next month we will see that come back down.

As for the other examples, they have all come down by around 0.1% to 0.3%. It seems the tariffs have helped to bring mortgage interest rates down which is helpful for us.

For the adverse products, I have also ignored the lenders who credit score applications as realistically although it is within criteria, the likelihood of being accepted is very very low.

Summary

Last month I wrote about how stamp duty could affect interest rates… Who knew all the news would be from the other side of the Atlantic! It just shows why we (mortgage brokers) can never accurately predict what will happen. We can only tell you what we hear but even the professionals in that field get it wrong.

There are talks of these tariffs getting rolled back, what effect that will have on mortgage rates, who knows? I think in the current climate its just a case of securing a product. With some lenders we can switch you to a new product if rates do come down prior to completion – but there are various caveats with that, so its best we discuss on an individual basis.