his post is the May update to our monthly review on what is happening with mortgage interest rates. You can see the previous months here:

Q4 2024 – October was missed, November, December

Q1 2025 – January, February, March.

I do these monthly posts as there has been a lot in the news about interest rates in recent years especially since the “mini budget”.

I found it confusing and I am a mortgage broker! It was quite frustrating to hear how interest rates are now under 5%, 4%, 3% etc, but the reality is that most people would not have been eligible for those products. Typically they were only eligible for people with 40% equity or a 40% deposit. And even those who were eligible may have been better off paying a higher interest rate as they usually came with high arrangement fees. .

What mortgage rates we are looking at?

I look at 4 types of mortgages. Mortgages that I think would appeal to a wider range of people than 60% LTV with a large fee!

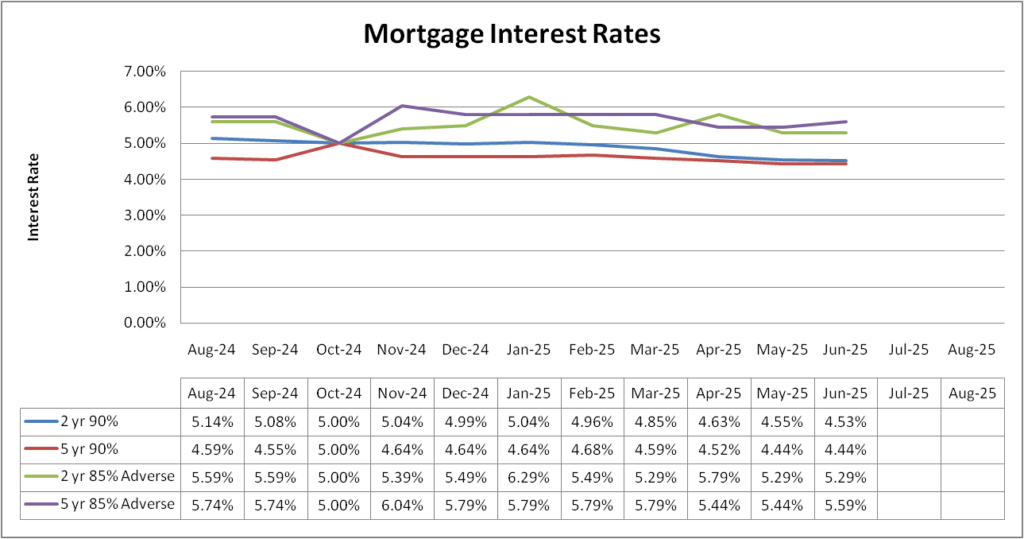

These 4 will remain the same so ensure a fair comparison. The 4 scenarios we are looking at are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

What mortgage rates are available now?

*October update I missed which is why its skewed that month.

I think this update needs to be split into 2 sections.

First, its a bit boring this month! This is what you would expect to happen in any normal month. There are a couple of tweaks to interest rates, but in general they are holding quite steady. As boring as this may be, its actually nice to have some stability.

Secondly, in the last few days there has been a lot going on with Iran and Israel in the last couple of days. I wont pretend to be smart enough to know how this will play into mortgage rates, but I think unless it calms down in the coming days or weeks we might see some changes to interest rates – up or down however I have no idea though.

Summary

In a nutshell, it is all calm on the Western front as my gran used to say. This is good, it takes away the panic of rates rising and people rushing. But also when rates are dropping it creates more work for us having to look at switching products to the new lower rates.

However, there are dark clouds on the horizon and that could lead to changes in mortgage rates.

It has been very busy in the last few weeks, I will happily take the calm for now. But next months might be a little more lively – time will tell!