Apologies for missing July’ post. My mum has been in hospital and so it took me away from the office for a little while (despite the comparison to superheroes and magicians at Mortgage Success, we are human).

Unlike most updates, August will likely have 2. The reason for this is because it is expected that the bank of England base rate will come down this week and also because I missed July. I thought it was important to get an update before the official announcement and after.

The reason I think it is important to do 2 updates this month is because there has been a lot of emails about rate reductions in the last 10 days or so. It will be interesting to see how much rates have come down BEFORE the base rate announcement compared to a week or so after.

You can see our previous updates here.

What mortgage rates we are looking at?

We always look at the same 4 scenarios, which are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999(ish) fee for adverse*

- 5 year fix at 85% LTV with a £999(ish) fee for adverse*

*Adverse in these examples is someone with 5 defaults from 2 years ago. Enough to mean we cant go to the high street.

What mortgage rates are available now?

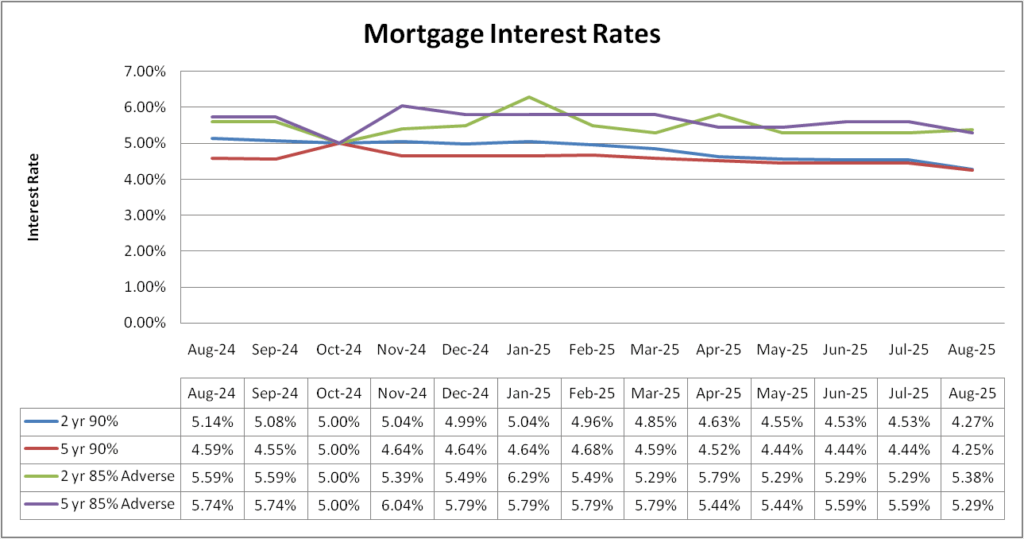

We missed October 2024 and July 2025 update. Looking at the high street, you can see that rates have already dropped by around 0.25% since June. Thats quite a big drop and suggests that the market has already priced in a base rate drop from the Bank of England later this week.

What will be interesting to see is whether there are further drops this week and next week after the announcement. My money is that there might be some fluctuations but rates will be more or less where they are now.

The adverse products however are a bit of a mixed bag. We can see below that the 2 year fixes are surprisingly more expensive. Bar a jump in April (which was due to other lenders pulling their rates), they have actually been very consistent for 5 months. I was not expecting to see them go up.

5 year fixes are 0.3% down. Again, that is not what I was expecting if I am being honest. I would have expected them to remain where they were.

Summary

The high street are definitely pushing ahead with the drop in rates. They are clearly expecting the base rate to come down by 0.25% later in the week.

Unlike the high street who tend to be proactive when it comes to altering rates. Specialist lenders tend to be more reactive. They seem to want to see what the markets will do before making any chances. That is why I am quite surprised the adverse lenders have moved so much already. I will be interested to see if they reduce their rates following the base rate announcement (assuming it does go down).