This post is the January update to our monthly review on what is happening with mortgage interest rates. You can see the previous months here:

The reason for this ongoing research update has come from there beeing a lot in the news about interest rates being up one minute and then down the next. What we read was confusing and/or misleading and we are mortgage brokers! Who remembers there being mortgages under 4% last year for example? There were! But they were typically up to 60% LTV and came with larger fees – which in reality meant about 95% of people were either not eligible or it was not useful for them. Then it was all doom and gloom with rates going up. But you will see from the table below a lot of it is just headlines.

What mortgage rates we are looking at?

To keep things things as fair as possible, I have looked at 4 types of mortgages. Mortgages that I think would appeal to a wider range of people than 60% LTV with a large fee! I have where possible capped the fees at £1,200 but tried to keep as close to £999 as possible.

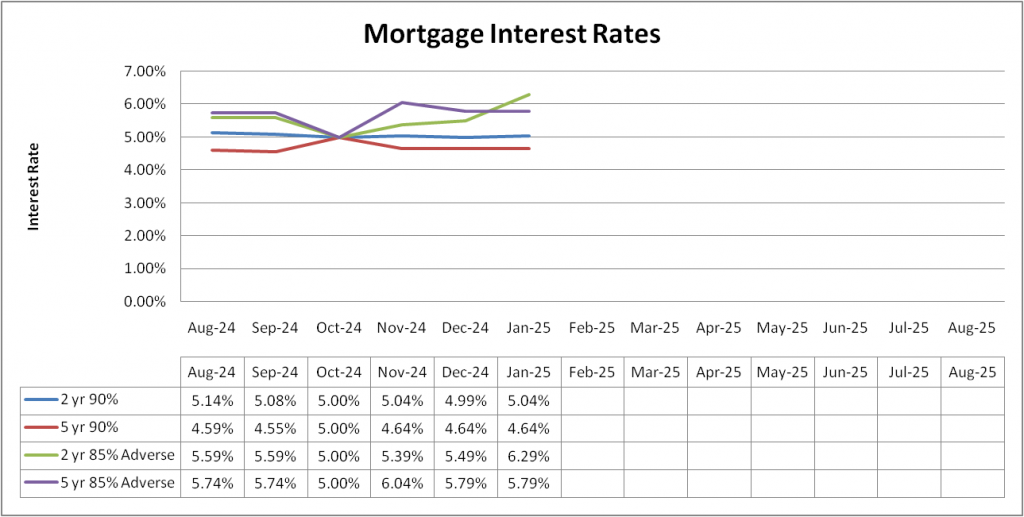

These 4 will remain the same so ensure a fair comparison. The 4 scenarios we are looking at are:

- 2 year fix at 90% LTV with a £999(ish) fee.

- 5 year fix at 90% LTV with a £999(ish) fee.

- 2 year fix at 85% LTV with a £999ish fee for adverse*

- 5 year fix at 85% LTV with a £999ish fee for adverse*

Adverse covers a lot, from some late payments through to defaults or CCJs or bankruptcy. For simplicity, I will say someone with 5 defaults for £1,000 each dated 2 years old at time of application. Enough to mean it will not be accepted on the high street but not the most severe end of adverse either.

What mortgage rates are available now?

I was too busy to update in October. I put the rate down as 5% just to fill in the box.

Over the last 6 months interest rates have remained fairly stable. This is despite all of the doom and gloom we read about the economy and bonds, gilts etc. However there has been a jump in one of the areas this month. I will explain that below.

Lets look at the green line first. It is the only bit of excitement I have seen on this table! The reason for it is quite simple, the 5 previous months there was a little building society who were offering better rates. Its not that interest rates have jumped up, it is just that one small lender who was leading the pack has reached their capacity and now we are looking at whoever was next. I suspect that lender will be back next month or the month after and assuming rates do remain steady we will see it come back down again.

Other than that, it is business as usually, those rows could not be any steadier if you tried! And this is exactly the reason why I wanted to do this. Listening to the news you would think mortgage rates are rocketing, but that is really not the case.

There are a couple of points which need to be noted. In some cases there may be cheaper products out there. However these products are only available to certain people. For example people who live in certain postcodes or are staying with your current mortgage lender. I have not included those products. I have tried to stick to products which are available on the open market to the majority of people.

For the adverse products, I have also ignored the lenders who credit score applications as realistically although it is within criteria, the likelihood of being accepted is very very low.

Summary

I think we all heard in the news about the recent budget and the effects it is having on the economy and finance. However from a mortgage perspective at the moment there is very little change.

In November and December I said I think rates will remain steady until February. That seems to be the case so far. I have no idea what will happen in the next month. Lenders seem to want to lend which is always a good sign, but there is a lot going on in the world so I will just refrain from making a prediction and see where we are.

Thankfully you have Mortgage Success on your side cutting through it all to be as transparent as we can be.